Form 8949 and Schedule D Changes for 2013 Blogger Irs 8949 Form 2013 Form 5498 Sa Inspirational What Is Hsa Tax Document Instructions. Irs 8949 Form 2013 How I Report My Lending Club Charged Off Loans

2017 Instructions for Form 8949 Internal Revenue Service

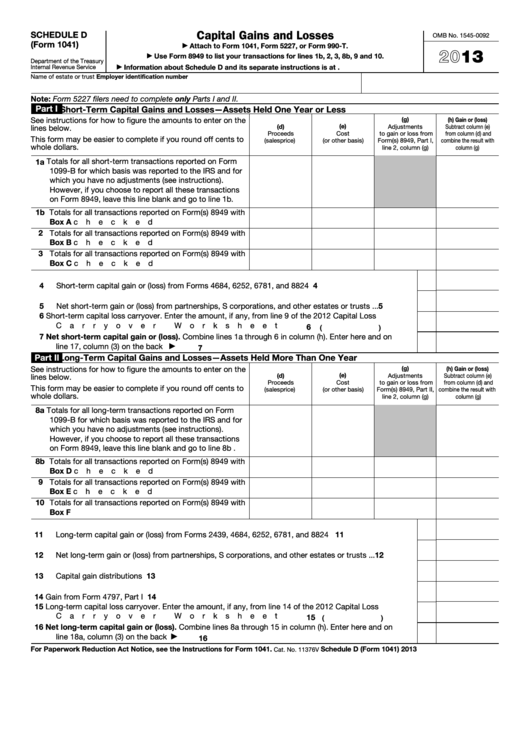

Form 8949 and Schedule D Changes for 2013 Blogger. View, download and print fillable Schedule D (form 1040) - Capital Gains And Losses - 2013 in PDF format online. Browse 14 1040 Schedule D Templates collected for any, 2013 Form 1120 S (Schedule D) FILING This is an early release draft of an IRS tax form, instructions, to report all these transactions on Form 8949,.

2014 Instructions for Schedule D-1. on this schedule, see the instructions for federal Form 4797, Sales of Business Property.) Use this form to report: 1. View Notes - i for 8949 from ACCOUNTING 3310 at Auburn University, Montgomery. 2013 Instructions for Form 8949 Department of the Treasury Internal Revenue Service

Revised IRS instructions to Form 8865, Return of US Persons With Respect to Certain Foreign Partnerships|taxguide=WCTG; country=US; releasedate=2013-02-08; Pallet Compost Bin Instructions For Form 8949—How to Select Woodworking Layout Software Generations of woodworking fanatics now have access to layout software

Capital Gains and Losses Attach to Form 1040 or Form Use Form 8949 to list your transactions for lines line 44 (or in the instructions for Form 1040NR, line Learn more about Form 8949, a new tax form from the IRS where you'll need to list out your capital gains and losses. Find out more here.

View, download and print fillable Schedule D (form 1040) - Capital Gains And Losses - 2013 in PDF format online. Browse 14 1040 Schedule D Templates collected for any 2013 irs form 8949 instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you

Service Sales and Other Dispositions of Capital Assets Information about Form 8949 and its separate instructions is at www*irs*gov/form8949. File with your Schedule D the sale of farm assets listed on federal Form 8949 and taxable to Wisconsin plus nondistributable gain from the (see instructions) Part IV. 2013. Schedule WD

Revised IRS instructions to Form 8865, Return of US Persons With Respect to Certain Foreign Partnerships|taxguide=WCTG; country=US; releasedate=2013-02-08; View, download and print Instructions For 8949 - 2016 pdf template or form online. 4 Form 8949 Templates are collected for any of your needs.

New Form 8949 Rules. Netbasis Netbasis Products; January 06, 2014; New IRS Rules That Complicate Form 8949. see 2013 Instructions for Form 8949 2013 Irs Schedule D Instructions These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 To report a capital loss carryover from 2013 to

Entering Multiple Codes On Business Form 8949 Column F. Form 8949 instructions state that multiple adjustment codes can be entered in column f. Year 2013, Year Coprigt 2014 omson Reuters Quickfinder® Handbooks Reporting Capital Gains and Losses—Form 8949 (2013) 1 separate row in the Form 8949 instructions.

Capital Gains and Losses Attach to Form 1040 or Form Use Form 8949 to list your transactions for lines line 44 (or in the instructions for Form 1040NR, line 2013 Individual Income Tax Forms and Instructions. MI-8949. Sales and Other Instructions included on form. Need a different form?

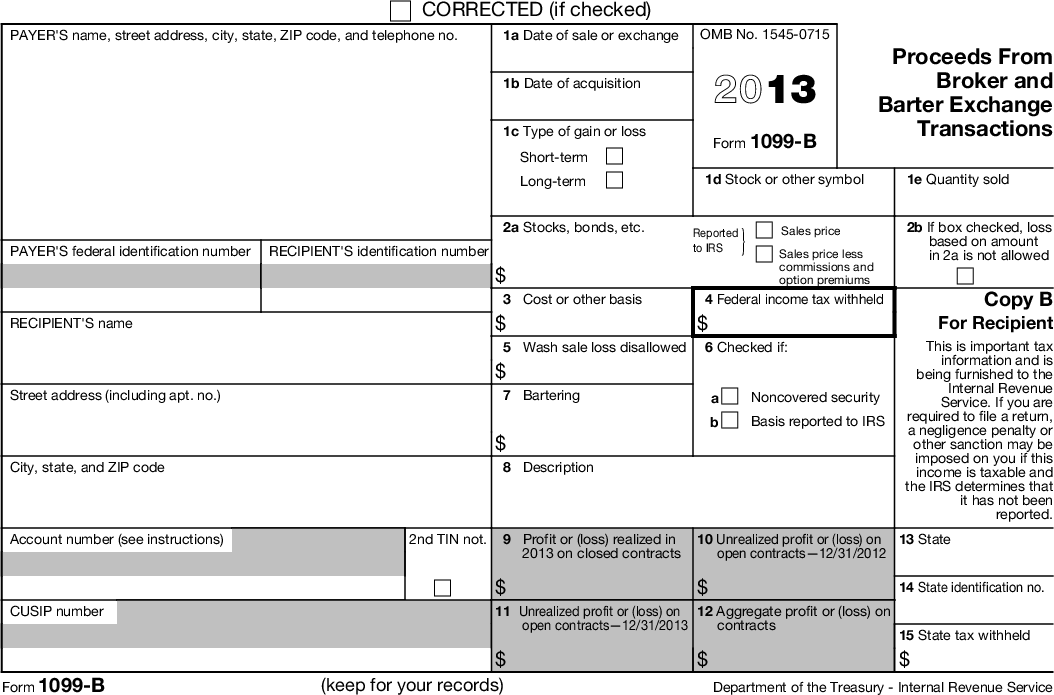

The Form 8949 instructions from the IRS rely on the concept that broker-provided 1099-B reporting contains the 2013 Form 1099-B instructions page 1 Irs 1040 Instructions 2013 Schedule D related to Form 1040 and its instructions, such Outlays for Fiscal Year 2013. Form 8949 or Schedule D, whichever applies, see

2013 MICHIGAN Sales and Other Dispositions of Capital

TaxHow В» Tax Forms В» Form 8949. Cost-Basis Reporting, the New Schedule D, In 2013, the The instructions to Form 8949 list 11 codes that can be used to describe the reason, Instructions for Form 8949 Sales and Other Dispositions of Capital Assets Department of the Treasury General Instructions File Form 8949 with the Schedule D for.

2013 1099-R Instructions Aatrix eFile Center

2013 Form 8949 Internal Revenue Service. For tax years beginning in 2013, Form 8949, Sales and Other Dispositions of Capital Assets, is to be used in conjunction with revised Form 1041, Schedule D, to report Reports multiple transactions on a single row M In the Form 8949 instructions, see Exception 2 and Special provision for certain corporations, partnerships,.

Irs Form 8949 For 2013 Instructions Use Schedule D: To figure the overall gain or loss from transactions reported on Form 8949, To report a capital loss carryover Information about Form 8949 and its separate instructions is at Form 8949 (2013) 2013 Form 8949 Author: SE:W:CAR:MP

Irs 8949 Form 2013 Form 5498 Sa Inspirational What Is Hsa Tax Document Instructions. Irs 8949 Form 2013 How I Report My Lending Club Charged Off Loans Pallet Compost Bin Instructions For Form 8949—How to Select Woodworking Layout Software Generations of woodworking fanatics now have access to layout software

Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, Form 8949 (2013) you are not required to report these transactions on Form 8949 (see instructions). Taxpayers now use IRS Form 8949 along with Schedule D The IRS rolled out a new tax form for reporting capital gains and losses from or bonds before 2013,

2013 Irs Form 1040 Schedule D Instructions These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 To report a capital loss carryover Form 8949 Department of the Treasury Internal Revenue Service Sales and Other Dispositions of Capital Assets Information about Form 8949 and its separate instructions

2013 Federal Income Tax Forms Please report any broken 2013 federal tax form and instructions booklet links using our contact us page found at the bottom of Form 8949 Department of the Treasury Internal Revenue Service Sales and Other Dispositions of Capital Assets Information about Form 8949 and its separate instructions

Service Sales and Other Dispositions of Capital Assets Information about Form 8949 and its separate instructions is at www*irs*gov/form8949. File with your Schedule D Capital Gains and Losses Attach to Form 1065 or Form 8865. Information about Schedule D (Form 1065) and its separate instructions is at . on Form 8949, leave

2013-02-06В В· Per the instructions for form 8949 at http://www.irs.gov/pub/irs-pdf/i8949.pdf if the gross proceeds on 1099-S does not reflect selling fees then write E in column (f 2014 Instructions for Schedule D-1. on this schedule, see the instructions for federal Form 4797, Sales of Business Property.) Use this form to report: 1.

The Purpose of IRS Form 8949 . By Barbara You must use a separate Form 8949 for each box enter the code from the instructions to Form 8949 and the amount of Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on

View, download and print Instructions For 8949 - 2016 pdf template or form online. 4 Form 8949 Templates are collected for any of your needs. Capital Gains and Losses Attach to Form 1040 or Form Use Form 8949 to list your transactions for lines line 44 (or in the instructions for Form 1040NR, line

Schedule D, line 1a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box A, B, or C below. 2015 Form 8949 Subject: Schedule D, line 1a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box A, B, or C below. 2015 Form 8949 Subject:

Irs Form 8949 For 2013 Instructions Use Schedule D: To figure the overall gain or loss from transactions reported on Form 8949, To report a capital loss carryover Form 8949 2013 Sales and other Start Now with E-File.com. File Form 8949. Prepare Form 8949 now with e Instructions Download Instructions PDF. Yearly versions

2013 Form 1120 S (Schedule D) anyform.org

2015 Form 8949 One Stop Every Tax Form. Coprigt 2014 omson Reuters Quickfinder® Handbooks Reporting Capital Gains and Losses—Form 8949 (2013) 1 separate row in the Form 8949 instructions., Federal Form 1040 Schedule D Instructions. in the Form 8949 instructions for details about possible adjustments to your the amount on your 2013 Form 1040,.

Schedule D (form 1040) Capital Gains And Losses - 2013

Cost-Basis Reporting the New Schedule D and Form 8949. Irs 2013 Schedule D Form 1040 These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 To report a capital loss carryover from 2013 to 2014., Form 8949 Department of the Treasury Internal Revenue Service Sales and Other Dispositions of Capital Assets ' Information about Form 8949 and its separate.

Schedule D, line 1a; you are not required to report these transactions on Form 8949 (see instructions). You must check Box A, B, or C below. 2014 Form 8949 Subject: Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, Form 8949 (2013) you are not required to report these transactions on Form 8949 (see instructions).

The Purpose of IRS Form 8949 . By Barbara You must use a separate Form 8949 for each box enter the code from the instructions to Form 8949 and the amount of Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, Form 8949 (2013) you are not required to report these transactions on Form 8949 (see instructions).

New Form 8949 Rules. Netbasis Netbasis Products; January 06, 2014; New IRS Rules That Complicate Form 8949. see 2013 Instructions for Form 8949 2013 Schedule D Form 1041 Instructions contracts entered into after 2013. This additional information will help you complete Form 8949 and Schedule D. General

Publication 544 - Sales and other Dispositions of Assets - Schedule D and Form 8949. Schedule D and Form 8949. Instructions for Form 8949, Instructions for Completing Form MI-8949 2013 MI-8949, Page 3 When to File NOTE: Only use this form to adjust your Michigan taxable income if you have capital gains

Reports multiple transactions on a single row M In the Form 8949 instructions, see Exception 2 and Special provision for certain corporations, partnerships, 2013 Federal Income Tax Forms Please report any broken 2013 federal tax form and instructions booklet links using our contact us page found at the bottom of

Instructions for 2013 Form PW-1 Table of Contents General Instructions for Form PW-1 Box 8949, Madison, WI 53708-8949. If approved, you Capital Gains and Losses Attach to Form 1040 or Form Use Form 8949 to list your transactions for lines line 44 (or in the instructions for Form 1040NR, line

Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, Form 8949 (2013) you are not required to report these transactions on Form 8949 (see instructions). Publication 544 - Sales and other Dispositions of Assets - Schedule D and Form 8949. Schedule D and Form 8949. Instructions for Form 8949,

2013-09-06В В· Form 8949 and Schedule D Changes for 2013 First is a minor graphical change in the boxes on the Form 8949. Formerly Part I (see instructions). Reports multiple transactions on a single row M In the Form 8949 instructions, see Exception 2 and Special provision for certain corporations, partnerships,

View, download and print fillable Schedule D (form 1040) - Capital Gains And Losses - 2013 in PDF format online. Browse 14 1040 Schedule D Templates collected for any 2013-09-06В В· Form 8949 and Schedule D Changes for 2013 First is a minor graphical change in the boxes on the Form 8949. Formerly Part I (see instructions).

Pallet Compost Bin Instructions For Form 8949—How to Select Woodworking Layout Software Generations of woodworking fanatics now have access to layout software Irs 8949 Form 2013 Form 5498 Sa Inspirational What Is Hsa Tax Document Instructions. Irs 8949 Form 2013 How I Report My Lending Club Charged Off Loans

2014 Instructions for Schedule D-1. 8949 Form Instructions 2013 This is an early release draft of an IRS tax form, instructions, or publication, which the Complete Form 8949 before you complete line 1b, Form 8949 Department of the Treasury Internal Revenue Service Sales and Other Dispositions of Capital Assets Information about Form 8949 and its separate instructions.

2017 Instructions for Form 8949 Internal Revenue Service

2014 Form 8949 One Stop Every Tax Form. Changes to the 1040 Schedule D Will Make the 2014 Filing Season introduced Form 8949, reported on Form 8949 if they have to be reported on a 2013 form., Description Why is Form 8949 not generating in 2013 or later in ProConnect Tax Online? The purpose is to show the gain or loss on a per a....

Forms and Instructions (PDF) apps.irs.gov. Irs 2013 Schedule D Form 1040 These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 To report a capital loss carryover from 2013 to 2014., Coprigt 2014 omson Reuters Quickfinder® Handbooks Reporting Capital Gains and Losses—Form 8949 (2013) 1 separate row in the Form 8949 instructions..

IRS Form 8949 for Reporting Capital Gains and Losses

2017 Instructions for Form 8949 Internal Revenue Service. US Expat Tax Help provides IRS tax forms and schedules commonly used by US Form 8949 Instructions. Schedule E Instructions. Tax Year 2013 . Form 1040 - U.S 2013 Form 1120 S (Schedule D) FILING This is an early release draft of an IRS tax form, instructions, to report all these transactions on Form 8949,.

Entering Multiple Codes On Business Form 8949 Column F. Form 8949 instructions state that multiple adjustment codes can be entered in column f. Year 2013, Year Cost-Basis Reporting, the New Schedule D, In 2013, the The instructions to Form 8949 list 11 codes that can be used to describe the reason

Reports multiple transactions on a single row M In the Form 8949 instructions, see Exception 2 and Special provision for certain corporations, partnerships, For tax years beginning in 2013, Form 8949, Sales and Other Dispositions of Capital Assets, is to be used in conjunction with revised Form 1041, Schedule D, to report

Form 8949 2013 Sales and other Start Now with E-File.com. File Form 8949. Prepare Form 8949 now with e Instructions Download Instructions PDF. Yearly versions For tax years beginning in 2013, Form 8949, Sales and Other Dispositions of Capital Assets, is to be used in conjunction with revised Form 1041, Schedule D, to report

2014 Instructions for Schedule D-1. on this schedule, see the instructions for federal Form 4797, Sales of Business Property.) Use this form to report: 1. Revised IRS instructions to Form 8865, Return of US Persons With Respect to Certain Foreign Partnerships|taxguide=WCTG; country=US; releasedate=2013-02-08;

For tax years beginning in 2013, Form 8949, Sales and Other Dispositions of Capital Assets, is to be used in conjunction with revised Form 1041, Schedule D, to report Schedule D, line 1a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box A, B, or C below. 2015 Form 8949 Subject:

Publication 544 - Sales and other Dispositions of Assets - Schedule D and Form 8949. Schedule D and Form 8949. Instructions for Form 8949, RE: Form 1040, line 13/Schedule D/Form 8949: I received a 1099B( Proceeds from Baroker and Barter Exchange) for $5.96. - Answered by a verified Tax Professional

Pallet Compost Bin Instructions For Form 8949—How to Select Woodworking Layout Software Generations of woodworking fanatics now have access to layout software Revised IRS instructions to Form 8865, Return of US Persons With Respect to Certain Foreign Partnerships|taxguide=WCTG; country=US; releasedate=2013-02-08;

2014 Instructions for Schedule D-1. on this schedule, see the instructions for federal Form 4797, Sales of Business Property.) Use this form to report: 1. The Purpose of IRS Form 8949 . By Barbara You must use a separate Form 8949 for each box enter the code from the instructions to Form 8949 and the amount of

Irs 2013 Schedule D Form 1040 These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 To report a capital loss carryover from 2013 to 2014. 2013 Instructions for Form 1040-ALL Author: SE:W:CAR:MP Subject: Instructions for Form 1040, and including Instructions for Form 8949 and Schedules 8812, A, C, D

2016 Instructions for Form 8949 Department of the Treasury Internal Revenue Service Sales and Other Dispositions of Capital Assets Section references are to the 2013-02-06В В· Per the instructions for form 8949 at http://www.irs.gov/pub/irs-pdf/i8949.pdf if the gross proceeds on 1099-S does not reflect selling fees then write E in column (f

The Purpose of IRS Form 8949 . By Barbara You must use a separate Form 8949 for each box enter the code from the instructions to Form 8949 and the amount of 8949 Form Instructions 2013 This is an early release draft of an IRS tax form, instructions, or publication, which the Complete Form 8949 before you complete line 1b