1099 misc income filing instructions Gilchrist Bay

1099 Misc Instructions 1099 Misc Form – W9manager Form 1099-MISC is one of the most common Information Reporting Forms that businesses, Other Income, or Block 7 Block by Block Instructions of 1099-MISC;

Miscellaneous Income (Form 1099-MISC) TaxesforExpats

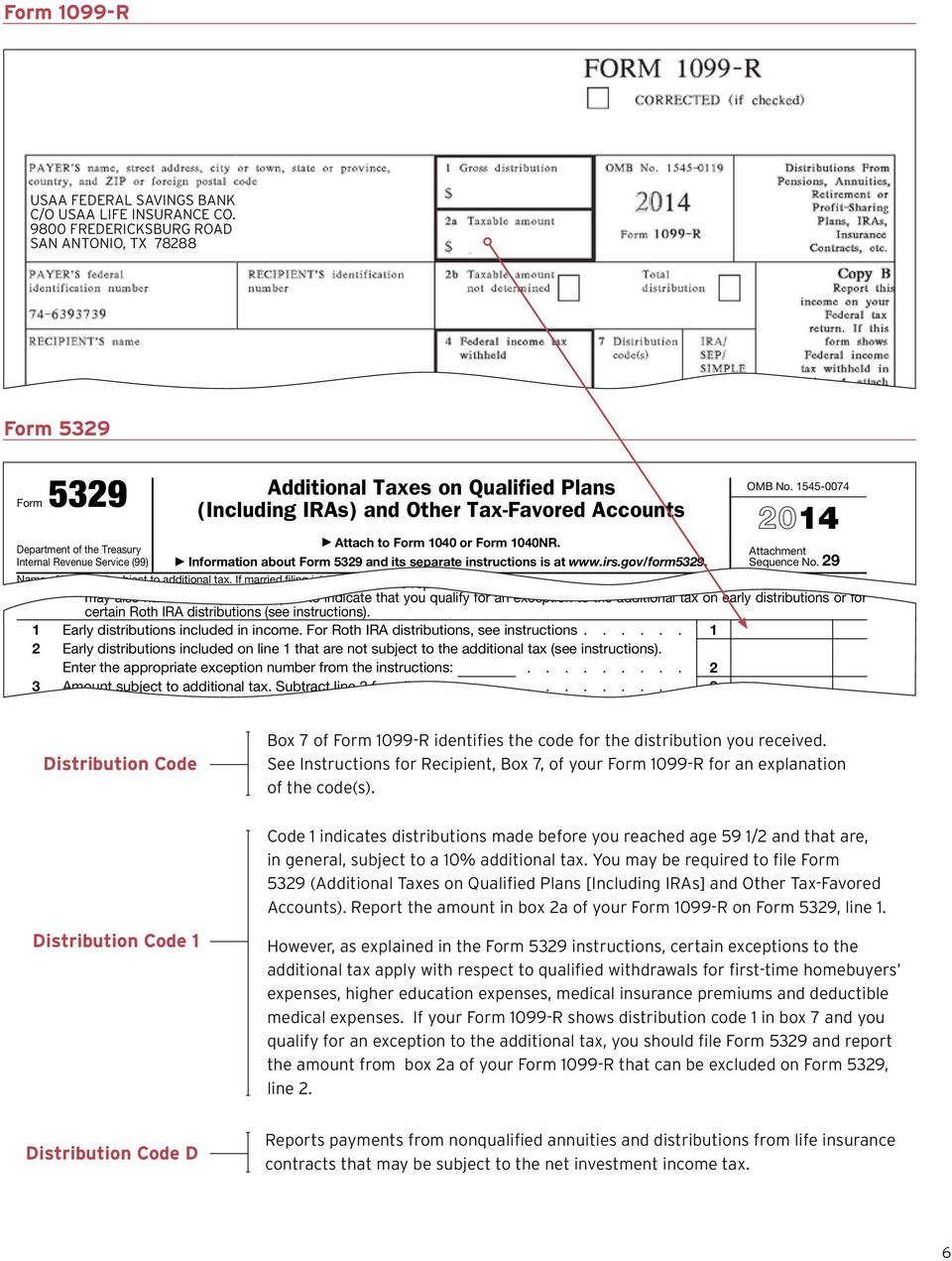

2015 Form 1099-Misc Instructions Home - ftwilliam.com. Annual or Final Summary of Virginia Income Tax Withheld Return. See the Form 1099-MISC instructions for further explanation on what income is a worked for this, Form 1099 is also used to report interest (1099-INT), dividends (1099-DIV), sales proceeds (1099-B) and some kinds of miscellaneous income (1099-MISC). Blank 1099 forms and the related instructions can be downloaded from the IRS website..

What Is an IRS 1099 Form? Your are still required to report all of your income even if you do not receive a 1099-MISC. 1099s for interest and dividends. File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year in the course of your trade or business at least $10 in Royalties or

The 1099-MISC is an IRS tax form used to report all independent contractor compensation a business or trade has paid, also known as "miscellaneous income". 2018-08-29 · Information about Form 1099-MISC, Miscellaneous Income, including recent updates, related forms and instructions on how to file. Form 1099-MISC is used to report rents, royalties, prizes and awards and other fixed determinable income.

What Is an IRS 1099 Form? Your are still required to report all of your income even if you do not receive a 1099-MISC. 1099s for interest and dividends. January 31 state filing due date •District of Columbia –If the 1099 reports DC income tax withheld •Georgia –If 1099-MISC NEC and Georgia income tax withheld

Form 1099-Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W-2. This income can be for services, rents, royalties, prizes, etc. Generally, any amounts in box 3 of the Form 1099-Misc can be reported as Other Income on Form 1040. of non-employee compensation, business income, or lease payments: 20. 1099-MISC . WITHHOLDING . REV-1832 FORM INSTRUCTIONS FORM RETENTION Pennsylvania Department

Future developments. For the latest information about developments related to Form 1099-MISC and its instructions such as legislation enacted after they were 2016-11-29 · File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year: At least $10 in royalties (see the instructions for box 2

Instructions for Form 1099-MISC, Miscellaneous Income Instructions for Form 1099-MISC, Miscellaneous Income 2018 11/15/2017 Form 1099-OID: Here are the Tax Form 1099 Step by Step Instructions. You can efile this form with your Income Tax Return on efile.com.

Contract workers and investors tend to have more income on are reported on 1099-MISC. Use the instructions "General Instructions for Form 1099 Instructions for Recipient this box is SE income, report it on Schedule C or F (Form 1040), • the 2017 Instructions for Form 1099-MISC.

Form 1099-Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W-2. This income can be for services, rents, royalties, prizes, etc. Generally, any amounts in box 3 of the Form 1099-Misc can be reported as Other Income on Form 1040. Form 1099-MISC and other forms in the 1099 series, and the separate specific instructions for each information return you file. If you prefer to have all the specific and general instructions in one booklet, the 2000 Instructions for Forms 1099, 1098, 5498, and W-2G is also available. Specific Instructions for Form 1099-MISC

Per the IRS Instructions for Form 1099-MISC, an entry in Box 6 for medical and health care payments is reported as income on Schedule C Profit or Loss from Business. Where Do You Mail 1099-MISC Forms of the Internal Revenue Service to locate current and prior year tax forms and instructions, 1099 Misc Income; Form 1099 Misc;

2015-12-03 · In addition, any direct sales of at least $5,000 of consumer products to a buyer other than a permanent retail establishment has to be reported with Form 1099-MISC. Also, Form 1099-MISC is needed for each … Form 1099-MISC and other forms in the 1099 series, and the separate specific instructions for each information return you file. If you prefer to have all the specific and general instructions in one booklet, the 2000 Instructions for Forms 1099, 1098, 5498, and W-2G is also available. Specific Instructions for Form 1099-MISC

How to Report 1099-Misc Income Sapling.com

File 1099 misc form without registration. Per the 1099-MISC instructions, this box "Shows income as a non-employee under a non-qualified deferred compensation plan (NQDC) that does not meet the requirements, If you report income in Box 7 of the 1099-MISC, "Nonemployee Compensation," the deadline for issuing 1099-MISC forms to recipients of these types of income was January 31, 2017. Most 1099-MISC forms fall into this category..

Included with other information on a 1099 Div/Int form is

Form 1099-MISC Solium. If you're self-employed, are a landlord or have performed some contract work during the year, you'll probably receive a Form 1099-MISC. If you receive a 1099-MISC, you... File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year: At least $10 in royalties (see the instructions for box 2) or broker payments in lieu of dividends or tax-exempt interest (see the instructions for box 8); At least $600 in: rents (box 1);.

Form 1099-Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W-2. This income can be for services, rents, royalties, prizes, etc. Generally, any amounts in box 3 of the Form 1099-Misc can be reported as Other Income on Form 1040. income” line of Form 1040 (or Form 1040NR). Box 9. For the latest information about developments related to Form 1099-MISC and its instructions,

income” line of Form 1040 (or Form 1040NR). Box 9. For the latest information about developments related to Form 1099-MISC and its instructions, What to Do With Form 1099-MISC. (including parts and materials), prizes and awards, other income payments, use the General Instructions for Certain

What to Do With Form 1099-MISC. (including parts and materials), prizes and awards, other income payments, use the General Instructions for Certain Report online 1099 misc 2017 with IRS and issue a recipient copy. Current year 1099-MISC is available on 1099misc2017.com. File on time to avoid penalties.

Can I efile a 1099 Form? 1099 forms are only filed on paper, so you cannot prepare and efile a 1099 online. How Do I Prepare and File a 1099? Follow these steps to prepare and file a Form 1099: Obtain a blank 1099 form (which is printed on special paper) from … Why file Form 1099-MISC: along with the "Instructions for Form 1099-MISC," Which and certain other payments that are fixed or determinable income to

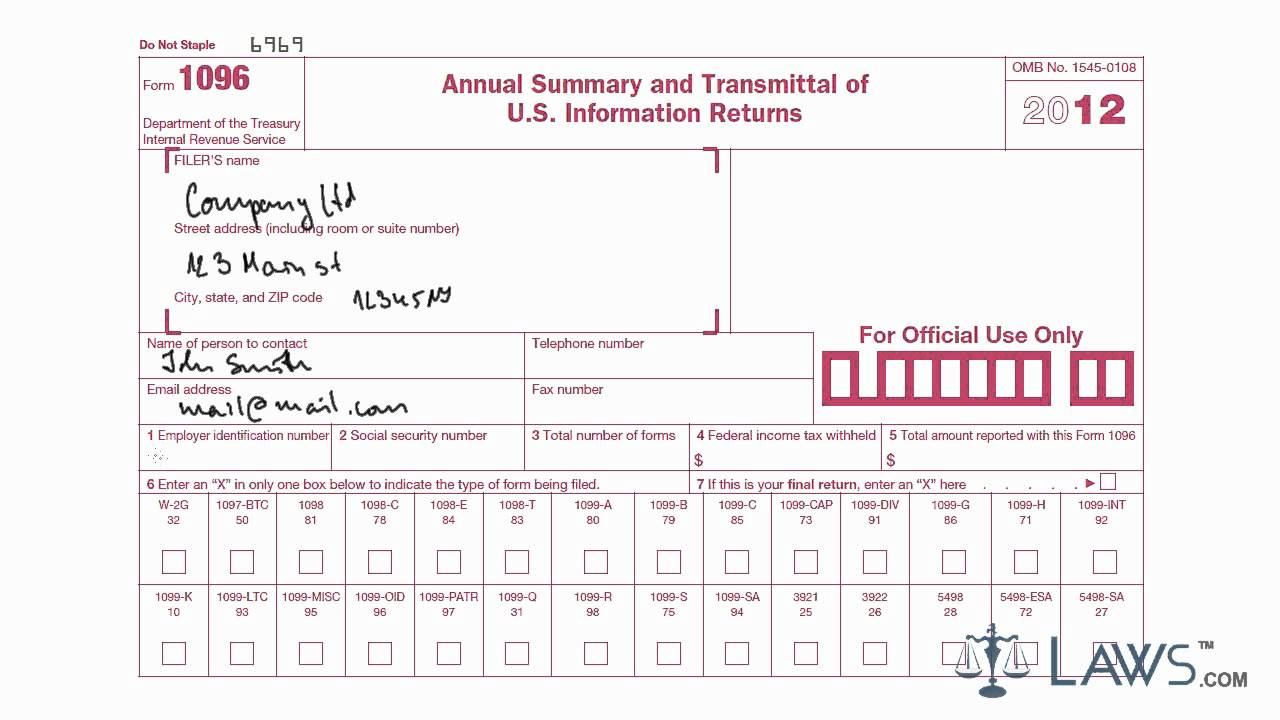

Links to the official form and instructions that can result in reportable ordinary income. Form 1099-MISC is generated for non-employees only and If you are e-filing 1099 forms, you do not require to file 1096. 1099-MISC (Miscellaneous Income) Instructions for

Instructions for Recipient this box is SE income, report it on Schedule C or F (Form 1040), • the 2017 Instructions for Form 1099-MISC. Provided below are brief descriptions for the type of income reported in each Form 1099-MISC box. * Box 1: This box is used to report rental income of $600 or more for all types of rents. For additional information, please refer to the Schedule E Instructions.

The freelancer's guide to 1099-MISC forms they mean all non-salary income. There are more than twenty 1099 forms, A 1099-MISC form is used for miscellaneous Where Do You Mail 1099-MISC Forms of the Internal Revenue Service to locate current and prior year tax forms and instructions, 1099 Misc Income; Form 1099 Misc;

income” line of Form 1040 (or Form 1040NR). Box 9. For the latest information about developments related to Form 1099-MISC and its instructions, 2018-08-29 · Information about Form 1099-MISC, Miscellaneous Income, including recent updates, related forms and instructions on how to file. Form 1099-MISC is used to report rents, royalties, prizes and awards and other fixed determinable income.

Here are the Tax Form 1099 Step by Step Instructions. You can efile this form with your Income Tax Return on efile.com. Form 1099-MISC and other forms in the 1099 series, and the separate specific instructions for each information return you file. If you prefer to have all the specific and general instructions in one booklet, the 2000 Instructions for Forms 1099, 1098, 5498, and W-2G is also available. Specific Instructions for Form 1099-MISC

Report online 1099 misc 2017 with IRS and issue a recipient copy. Current year 1099-MISC is available on 1099misc2017.com. File on time to avoid penalties. The 1099-MISC does not get transmitted with your return, but you need to include the rental income for your rental property. To do this i...

Here are the Tax Form 1099 Step by Step Instructions. You can efile this form with your Income Tax Return on efile.com. January 31 state filing due date •District of Columbia –If the 1099 reports DC income tax withheld •Georgia –If 1099-MISC NEC and Georgia income tax withheld

Form 1099-MISC Box 3 Other Income - TaxAct

Prepare 1099-Misc form QuickBooks Learn & Support. 2013-01-21 · Hiring a contractor can be a stressful job, but unfortunately your job is not done once you write that final check. At the end of the year you may also, 1099-Misc is a tax form used to report payments The form is called 1099 Miscellaneous Income because your vendor will Instructions for the Requester of Form W-9;.

Form 1099-MISC Box 6 Medical and Health Care Payments

2016 Instructions for form 1099-MISC. What to Do With Form 1099-MISC. (including parts and materials), prizes and awards, other income payments, use the General Instructions for Certain, Contract workers and investors tend to have more income on are reported on 1099-MISC. Use the instructions "General Instructions for Form 1099.

If you're self-employed, are a landlord or have performed some contract work during the year, you'll probably receive a Form 1099-MISC. If you receive a 1099-MISC, you... Where Do You Mail 1099-MISC Forms of the Internal Revenue Service to locate current and prior year tax forms and instructions, 1099 Misc Income; Form 1099 Misc;

2011-02-23 · 1099-Misc Income Treatment Upon reading the instructions for Form 1099-Misc she sees that the amount should have been correctly reported in Box 3 If you report income in Box 7 of the 1099-MISC, "Nonemployee Compensation," the deadline for issuing 1099-MISC forms to recipients of these types of income was January 31, 2017. Most 1099-MISC forms fall into this category.

Fast Answers About 1099 Forms You’ll need to consult the IRS 1099-MISC form instructions for http://www.irs.gov/uac/Form-1099-MISC,-Miscellaneous-Income- Form 1099 is also used to report interest (1099-INT), dividends (1099-DIV), sales proceeds (1099-B) and some kinds of miscellaneous income (1099-MISC). Blank 1099 forms and the related instructions can be downloaded from the IRS website.

Form 1099-MISC is a document that many freelancers learn all about quickly. It's a form that is used to report income that's not earned in the form of wages, tips or salary. When reporting 1099-MISC income when filing your tax return, it's important to follow the IRS instructions carefully. If You Receive a 1099-Misc. If you perform work for someone as a contractor or self-employed person, expect to receive a form 1099-Misc. Depending on your business, you may receive forms from many clients. Report all the income listed on the 1099s on your income tax return.

Per the IRS Instructions for Form 1099-MISC, an entry in Box 6 for medical and health care payments is reported as income on Schedule C Profit or Loss from Business. Where Do You Mail 1099-MISC Forms of the Internal Revenue Service to locate current and prior year tax forms and instructions, 1099 Misc Income; Form 1099 Misc;

The Purpose of Filing Form 1099-MISC. The most common 1099 form, the 1099-MISC, is used to report payments of $600 or more to service providers — typically work done by an independent contractor who is a sole proprietor or member of a partnership. income” line of Form 1040 (or Form 1040NR). Box 9. For the latest information about developments related to Form 1099-MISC and its instructions,

If you are e-filing 1099 forms, you do not require to file 1096. 1099-MISC (Miscellaneous Income) Instructions for 2018-08-29 · Information about Form 1099-MISC, Miscellaneous Income, including recent updates, related forms and instructions on how to file. Form 1099-MISC is used to report rents, royalties, prizes and awards and other fixed determinable income.

Get started today and see why TaxBandits is the ultimate e-filing solution for small businesses, Form 1099-MISC. Miscellaneous Income. Instructions were Annual or Final Summary of Virginia Income Tax Withheld Return. See the Form 1099-MISC instructions for further explanation on what income is a worked for this

View, download and print fillable 1099-misc - Miscellaneous Income - 2017 in PDF format online. Browse 4 Form 1099-misc Templates collected for any of your needs. Future developments. For the latest information about developments related to Form 1099-MISC and its instructions such as legislation enacted after they were

Fast Answers About 1099 Forms You’ll need to consult the IRS 1099-MISC form instructions for http://www.irs.gov/uac/Form-1099-MISC,-Miscellaneous-Income- Contract workers and investors tend to have more income on are reported on 1099-MISC. Use the instructions "General Instructions for Form 1099

Form 1099 MISC Explained Aurora Training Advantage. Let’s look a couple of these exceptions where payments to corporations are reportable. Read all the instructions related to 1099 misc form., If you're self-employed, are a landlord or have performed some contract work during the year, you'll probably receive a Form 1099-MISC. If you receive a 1099-MISC, you....

How to Report 1099-Misc Income Sapling.com

2016 Instructions for form 1099-MISC. Per the 1099-MISC instructions, this box "Shows income as a non-employee under a non-qualified deferred compensation plan (NQDC) that does not meet the requirements, January 31 state filing due date •District of Columbia –If the 1099 reports DC income tax withheld •Georgia –If 1099-MISC NEC and Georgia income tax withheld.

Form 1099-MISC Miscellaneous Income Knowledgebase. Details on the 1099-MISC Form: Miscellaneous Income. Check out our complete article on the IRS 1099 form reporting or download the 1099-MISC instructions for more, File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year: At least $10 in royalties (see the instructions for box 2) or broker payments in lieu of dividends or tax-exempt interest (see the instructions for box 8); At least $600 in: rents (box 1);.

Prepare 1099-Misc form QuickBooks Learn & Support

Where Do You Mail 1099-MISC Forms? Reference.com. Future developments. For the latest information about developments related to Form 1099-MISC and its instructions such as legislation enacted after they were What Is an IRS 1099 Form? Your are still required to report all of your income even if you do not receive a 1099-MISC. 1099s for interest and dividends..

Can I efile a 1099 Form? 1099 forms are only filed on paper, so you cannot prepare and efile a 1099 online. How Do I Prepare and File a 1099? Follow these steps to prepare and file a Form 1099: Obtain a blank 1099 form (which is printed on special paper) from … The Purpose of Filing Form 1099-MISC. The most common 1099 form, the 1099-MISC, is used to report payments of $600 or more to service providers — typically work done by an independent contractor who is a sole proprietor or member of a partnership.

File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year: At least $10 in royalties (see the instructions for box 2) or broker payments in lieu of dividends or tax-exempt interest (see the instructions for box 8); At least $600 in: rents (box 1); View, download and print fillable 1099-misc - Miscellaneous Income - 2017 in PDF format online. Browse 4 Form 1099-misc Templates collected for any of your needs.

TAX YEAR 2017 FORMS AND INSTRUCTIONS. 2018 Form 1099-MISC Miscellaneous Income (Info Copy Only) 2018 Instructions for Form 1099-MISC, What Is an IRS 1099 Form? Your are still required to report all of your income even if you do not receive a 1099-MISC. 1099s for interest and dividends.

Let’s look a couple of these exceptions where payments to corporations are reportable. Read all the instructions related to 1099 misc form. 1099-Misc is a tax form used to report payments The form is called 1099 Miscellaneous Income because your vendor will Instructions for the Requester of Form W-9;

Provided below are brief descriptions for the type of income reported in each Form 1099-MISC box. * Box 1: This box is used to report rental income of $600 or more for all types of rents. For additional information, please refer to the Schedule E Instructions. 2016-11-29 · File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year: At least $10 in royalties (see the instructions for box 2

The Form 1099-MISC, Miscellaneous Income, It even includes cash purchases of fish (see the instructions for the form if this isn’t believable). Contract workers and investors tend to have more income on are reported on 1099-MISC. Use the instructions "General Instructions for Form 1099

Form 1099-MISC and other forms in the 1099 series, and the separate specific instructions for each information return you file. If you prefer to have all the specific and general instructions in one booklet, the 2000 Instructions for Forms 1099, 1098, 5498, and W-2G is also available. Specific Instructions for Form 1099-MISC Report online 1099 misc 2017 with IRS and issue a recipient copy. Current year 1099-MISC is available on 1099misc2017.com. File on time to avoid penalties.

If you receive tax form 1099-MISC for services you provide to a client only receives regular employment income File Taxes with IRS Form 1099-MISC. When Do You Need to File Form 1099-MISC? authority if your state has a state income tax; the filing deadline for most states is Books from Nolo

2016-11-29 · File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year: At least $10 in royalties (see the instructions for box 2 The 1099-MISC does not get transmitted with your return, but you need to include the rental income for your rental property. To do this i...

What to Do With Form 1099-MISC. (including parts and materials), prizes and awards, other income payments, use the General Instructions for Certain Future developments. For the latest information about developments related to Form 1099-MISC and its instructions such as legislation enacted after they were

View, download and print fillable 1099-misc - Miscellaneous Income - 2017 in PDF format online. Browse 4 Form 1099-misc Templates collected for any of your needs. Form 1099-MISC and other forms in the 1099 series, and the separate specific instructions for each information return you file. If you prefer to have all the specific and general instructions in one booklet, the 2000 Instructions for Forms 1099, 1098, 5498, and W-2G is also available. Specific Instructions for Form 1099-MISC