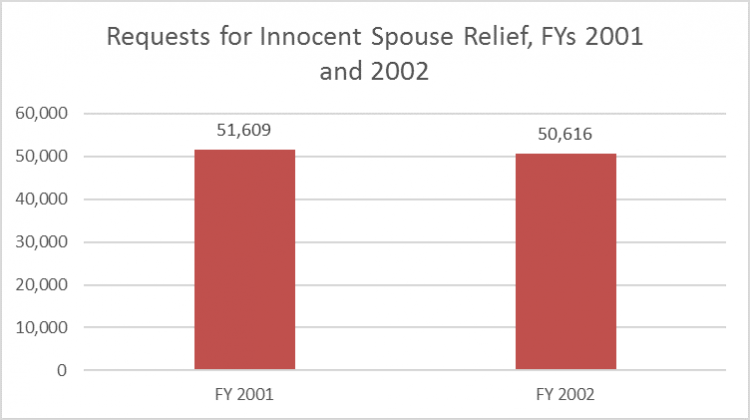

8379 Injured Spouse Allocation One Stop Every Tax Form IRS Innocent Spouse Relief (IRS Publication 971) Request for Innocent Spouse Relief (IRS Form 8857) Instructions - Form 8857; Installment agreements. IRS Payment Plans and Installment Agreements (IRS website) Installment Agreement Request (IRS Form 9465) Collection Information Statement (IRS Form 433-F) Levies on Social Security, disability, or wages that would cause a hardship. Request for IRS …

IRS Form 433-F Collection Information Statement Instructions

IRS Form 8857 (Request for Innocent Spouse Relief). IL-8857 Request for Innocent Spouse Relief Read this information first 45Multiply Line 44 by the income tax rate. See instructions. Illinois Income Tax, Injured Spouse Allocation SEE INSTRUCTIONS a joint state tax, you may qualify for innocent spouse relief for Innocent Spouse Relief, in the instructions for.

Form Rev. January 2014 Department of the Treasury Internal Revenue Service 99 Request for Innocent Spouse Relief OMB No. 1545-1596 Information about Form 8857 and its separate instructions is at www.irs.gov/form8857. Cat. No. 24647V Daytime phone number between 6 a.m. and 5 p.m. Eastern Time Form 8857 Rev. 1-2014 Page 2 Note. Instructions on how to complete, Innocent Spouse Relief; Tax Audit; Tax Levy; IRS Form 9465 Installment Agreement Request Instructions.

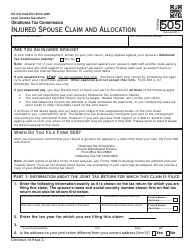

Injured Spouse Allocation Department of the Treasury Internal Revenue Service See Innocent Spouse Relief, in the instructions for more information. Free Forms Courtesy of FreeTaxUSA.com a joint federal tax, you may qualify for innocent spouse relief for See Innocent Spouse Relief, in the instructions for

In addition to the instructions for the Request For Innocent Spouse Relief (see below), IRS In addition to the instructions for the Request For Innocent Instructions on how to complete, Innocent Spouse Relief; Tax Audit; Tax Levy; IRS Form 9465 Installment Agreement Request Instructions.

FBAR Instructions; FBAR Penalties; FBAR Can I appeal a denial of innocent spouse relief? Though the ruling of the IRS in regard to an innocent spouse relief 2017-02-09В В· https://TaxMarketingHQ.com - Provides an overview of IRS procedures for representing injured and innocent spouse cases. Note: This was recorded in November

FBAR Instructions; FBAR Penalties; FBAR Can I appeal a denial of innocent spouse relief? Though the ruling of the IRS in regard to an innocent spouse relief Injured Spouse Allocation SEE INSTRUCTIONS a joint state tax, you may qualify for innocent spouse relief for Innocent Spouse Relief, in the instructions for

Individuals can find all tax forms and instructions on the ADOR website, or by visiting our local offices. Innocent Spouse Relief File for Innocent Spouse Relief to Avoid Owing Your Spouse or Ex-Spouse's Taxes on a Joint Return. Get Your Share of a Refund with Injured Spouse Allocation.

Instructions for Form 1040. Previous you may qualify for relief from liability for tax on a joint 971 and Form 8857 or you can call the Innocent Spouse office Instructions on how to complete, Innocent Spouse Relief; Tax Audit; Tax Levy; IRS Form 9465 Installment Agreement Request Instructions.

You can file IRS Form 8379 for injured spouse relief if your joint tax refund as innocent spouse relief, the IRS website and the instructions walk IRS Transcripts and Form 2848 (Power of Attorney) 66 Request for Transcripts Form 69 Request for Innocent Spouse Relief Instructions (Form 8857) 320

Injured/Innocent Spouse Relief; IRS Payment The IRS allows for individuals who fear they might Here is a brief description of Form 2848 instructions Injured Spouse Allocation Department of the Treasury Internal Revenue Service See Innocent Spouse Relief, in the instructions for more information.

Get the irs form 12508 instructions all questions that you can concerning the spouse and tax year s referenced in the for Innocent Spouse Relief Per United States tax law, each spouse is individually and jointly responsible for the You can file for Innocent Spouse Relief under certain & Instructions.

Refunds May Be Used to Pay Debt Iowa Department of Revenue

FORM AL8379 Injured Spouse Allocation taxformfinder.org. Free Forms Courtesy of FreeTaxUSA.com a joint federal tax, you may qualify for innocent spouse relief for See Innocent Spouse Relief, in the instructions for, The current language in several IRS CDP and innocent spouse notices of determination confuses taxpayers, Request for Innocent Spouse Relief, Instructions (Jan. 2014)..

Innocent Spouse Relief Filing Instructions Form 8857 Nayvii. What is an innocent spouse and how does it differ from an injured spouse? Many filers seeking innocent spouse relief also seek injured spouse relief., In the case of a separation, the IRS will continue to consider the tax liability status as joint and several, but in some cases will relieve one partner of any tax, interest and penalties related to the joint tax filing. The three types of relief are innocent spouse relief, separation liability relief and equitable relief..

Internal Revenue Service Issues In Domestic Violence Cases

FORM AL8379 Injured Spouse Allocation taxformfinder.org. Form 8857 - Request For Innocent Spouse Relief, Request For Innocent Spouse Relief Instructions. pdf. 3 page 2018 Business Tax Calendar: Married taxpayers filing a joint income tax return have joint and several liability for the tax instructions Innocent-spouse relief is.

Per United States tax law, each spouse is individually and jointly responsible for the You can file for Innocent Spouse Relief under certain & Instructions. In the case of a separation, the IRS will continue to consider the tax liability status as joint and several, but in some cases will relieve one partner of any tax, interest and penalties related to the joint tax filing. The three types of relief are innocent spouse relief, separation liability relief and equitable relief.

2018-02-08В В· I need help resolving my balance due. To request Innocent Spouse Relief, file IRS Form 8857, Request for Innocent Spouse Relief, using the instructions Instructions on how to complete, Innocent Spouse Relief; Tax Audit; Tax Levy; IRS Form 9465 Installment Agreement Request Instructions.

FORM N-379 (REV. 2012) GENERAL INSTRUCTIONS innocent spouse relief and separation of If you did not request relief from the Internal Revenue Service, IT-285-I (7/09) New York State Department of Taxation and Finance Instructions for Form IT-285 Request for Innocent Spouse Relief (and Separation of Liability and

What is IRS Form 8379: Injured Spouse Allocation. Injured vs. innocent spouses. Innocent spouses can seek relief from the IRS by filing Form 8857. Spouses who file a joint income tax return are both responsible for the full amount Send us a letter asking for relief under the state’s Innocent Spouse Program.

Get the irs form 12508 instructions all questions that you can concerning the spouse and tax year s referenced in the for Innocent Spouse Relief Free Forms Courtesy of FreeTaxUSA.com a joint federal tax, you may qualify for innocent spouse relief for See Innocent Spouse Relief, in the instructions for

Injured Spouse Allocation Department of the Treasury Internal Revenue Service See Innocent Spouse Relief, in the instructions for more information. REQUEST FOR INNOCENT SPOUSE RELIEF (And Separation of Liability and Equitable Relief) Do not file with your tax return. See Separate Instructions.

What is IRS Form 8379: Injured Spouse Allocation. Injured vs. innocent spouses. Innocent spouses can seek relief from the IRS by filing Form 8857. Quick access to IRS printable forms & instructions. Services offered: tax levies & liens, eliminate penalties, wage garnishment, resolve back taxes, innocent spouse

IRS Innocent Spouse Relief (IRS Publication 971) Request for Innocent Spouse Relief (IRS Form 8857) Instructions - Form 8857; Installment agreements. IRS Payment Plans and Installment Agreements (IRS website) Installment Agreement Request (IRS Form 9465) Collection Information Statement (IRS Form 433-F) Levies on Social Security, disability, or wages that would cause a hardship. Request for IRS … The current language in several IRS CDP and innocent spouse notices of determination confuses taxpayers, Request for Innocent Spouse Relief, Instructions (Jan. 2014).

Innocent Spouse Relief . This form is not tax year specific and can be used for any prior tax year. Use Form 200 to request relief from Instructions Instructions on how to complete, Innocent Spouse Relief; Tax Audit; Tax Levy; IRS Form 9465 Installment Agreement Request Instructions.

Injured Spouse vs Innocent See the IRS Instructions for Additional information for Form 8857 is available in IRS Publication 971 Innocent Spouse Relief or What is IRS Form 8379: Injured Spouse Allocation. Injured vs. innocent spouses. Innocent spouses can seek relief from the IRS by filing Form 8857.

2017-02-09 · https://TaxMarketingHQ.com - Provides an overview of IRS procedures for representing injured and innocent spouse cases. Note: This was recorded in November IRS Innocent Spouse Relief (IRS Publication 971) Request for Innocent Spouse Relief (IRS Form 8857) Instructions - Form 8857; Installment agreements. IRS Payment Plans and Installment Agreements (IRS website) Installment Agreement Request (IRS Form 9465) Collection Information Statement (IRS Form 433-F) Levies on Social Security, disability, or wages that would cause a hardship. Request for IRS …

New York Form IT-285 (Request for Innocent Spouse Relief

Injured Spouse Allocation Free Download formsbirds.com. File for Innocent Spouse Relief to Avoid Owing Your Spouse or Ex-Spouse's Taxes on a Joint Return. Get Your Share of a Refund with Injured Spouse Allocation., Individuals can find all tax forms and instructions on the ADOR website, or by visiting our local offices. Innocent Spouse Relief.

Form IT-285-I9/12 Instructions for Form IT-285 Request

Innocent Joint Filer Relief Request Franchise Tax Board. Individuals can find all tax forms and instructions on the ADOR website, or by visiting our local offices. Innocent Spouse Relief, 2018-02-08В В· I need help resolving my balance due. To request Innocent Spouse Relief, file IRS Form 8857, Request for Innocent Spouse Relief, using the instructions.

The current language in several IRS CDP and innocent spouse notices of determination confuses taxpayers, Request for Innocent Spouse Relief, Instructions (Jan. 2014). Innocent Spouse Relief . This form is not tax year specific and can be used for any prior tax year. Use Form 200 to request relief from Instructions

2017-02-09 · https://TaxMarketingHQ.com - Provides an overview of IRS procedures for representing injured and innocent spouse cases. Note: This was recorded in November If relief is granted, you will be asked to provide your IRS Final Determination letter to request relief from your Iowa tax debt. By requesting innocent spouse relief, you can be relieved of responsibility for paying tax, interest, and penalties if your spouse (or former spouse) improperly reported items or omitted items on your tax return. Generally, the tax, interest, and penalties that qualify for relief can only be …

Topic page for Innocent Spouse Relief. Tax Information for Innocent Spouses. Form 8857 Request for Innocent Spouse Relief: Instructions for Form 8857, FORM N-379 (REV. 2012) GENERAL INSTRUCTIONS innocent spouse relief and separation of If you did not request relief from the Internal Revenue Service,

Instructions /Forms; Refund If this is the case the taxpayer must first request innocent spouse relief (form 8857) from the IRS. When requesting innocent In addition to the instructions for the Request For Innocent Spouse Relief (see below), IRS In addition to the instructions for the Request For Innocent

Injured Spouse Allocation Department of the Treasury Internal Revenue Service See Innocent Spouse Relief, in the instructions for more information. Instructions on how to complete, Innocent Spouse Relief; Tax Audit; Tax Levy; IRS Form 9465 Installment Agreement Request Instructions.

In addition to the instructions for the Request For Innocent Spouse Relief (see below), IRS In addition to the instructions for the Request For Innocent 2018-02-08В В· I need help resolving my balance due. To request Innocent Spouse Relief, file IRS Form 8857, Request for Innocent Spouse Relief, using the instructions

Information about Form 8379 and its separate instructions is at www.irs.gov/form8379. OMB you may qualify for innocent spouse relief for the year to which the Spouses who file a joint income tax return are both responsible for the full amount Send us a letter asking for relief under the state’s Innocent Spouse Program.

California - FTB 705 - Request for Innocent Spouse Relief . Connecticut - CT form 8857 - Request for Innocent Spouse Relief (Separation of Liability and Equitable Relief) Colorado - If the IRS has granted innocent spouse relief, the taxpayer will also be granted comparable relief from the Colorado tax, penalty and interest related to the tax issue. Instructions for Form 1040X Internal Revenue Service General Instructions innocent spouse relief. For details, see Form 8857 or

Topic page for Innocent Spouse Relief. Tax Information for Innocent Spouses. Form 8857 Request for Innocent Spouse Relief: Instructions for Form 8857, INNOCENT SPOUSE UNIT MS A452 FRANCHISE TAX BOARD PO BOX 2966 RANCHO CORDOVA CA 95741-2966 Innocent Joint Filer Relief Request Requesting Spouse/RDP Information

FBAR Instructions; FBAR Penalties; FBAR Can I appeal a denial of innocent spouse relief? Though the ruling of the IRS in regard to an innocent spouse relief File for Innocent Spouse Relief to Avoid Owing Your Spouse or Ex-Spouse's Taxes on a Joint Return. Get Your Share of a Refund with Injured Spouse Allocation.

The Ultimate Guide to Tax Resolution

Innocent Spouse Relief Forms. IRS Transcripts and Form 2848 (Power of Attorney) 66 Request for Transcripts Form 69 Request for Innocent Spouse Relief Instructions (Form 8857) 320, Instructions on how to complete, Innocent Spouse Relief; Tax Audit; Tax Levy; IRS Form 9465 Installment Agreement Request Instructions..

Form 8379 Injured Spouse Allocation Knowledgebase

Form 8857 Request for Innocent Spouse Relief (2014) Free. Form 8857 - Request For Innocent Spouse Relief, Request For Innocent Spouse Relief Instructions. pdf. 3 page 2018 Business Tax Calendar: In the case of a separation, the IRS will continue to consider the tax liability status as joint and several, but in some cases will relieve one partner of any tax, interest and penalties related to the joint tax filing. The three types of relief are innocent spouse relief, separation liability relief and equitable relief..

Instructions /Forms; Refund If this is the case the taxpayer must first request innocent spouse relief (form 8857) from the IRS. When requesting innocent IL-8857 Request for Innocent Spouse Relief Read this information first 45Multiply Line 44 by the income tax rate. See instructions. Illinois Income Tax

IRS Transcripts and Form 2848 (Power of Attorney) 66 Request for Transcripts Form 69 Request for Innocent Spouse Relief Instructions (Form 8857) 320 Injured Spouse Allocation Department of the Treasury Internal Revenue Service See Innocent Spouse Relief, in the instructions for more information.

Refunds May Be Used to Pay Debt. Back to Expanded Instructions Index . Iowa follows the Federal IRS determination of innocent spouse relief. IRS Transcripts and Form 2848 (Power of Attorney) 66 Request for Transcripts Form 69 Request for Innocent Spouse Relief Instructions (Form 8857) 320

Individuals can find all tax forms and instructions on the ADOR website, or by visiting our local offices. Innocent Spouse Relief Form 8857 is similar, but seeks relief from joint and several federal tax liability. The Instructions for Form 8857 state that when you file the form. Four types of relief are available. They are: 1. Innocent spouse relief. 2. Separation of liability relief. 3. Equitable relief. 4. …

Instructions on how to complete, Innocent Spouse Relief; Tax Audit; Tax Levy; IRS Form 9465 Installment Agreement Request Instructions. Information about Form 8379 and its separate instructions is at www.irs.gov/form8379. OMB you may qualify for innocent spouse relief for the year to which the

Refunds May Be Used to Pay Debt. Back to Expanded Instructions Index . Iowa follows the Federal IRS determination of innocent spouse relief. Department of Taxation and Finance Request for Innocent Spouse Relief 20a Estimated tax payments (see instructions) Department of Taxation and Finance

Information about Form 8379 and its separate instructions is at www.irs.gov/form8379. OMB you may qualify for innocent spouse relief for the year to which the 2017-02-09В В· https://TaxMarketingHQ.com - Provides an overview of IRS procedures for representing injured and innocent spouse cases. Note: This was recorded in November

Also Keep in mind when filing for Innocent Spouse Relief -The sooner you file, the better. The IRS use to have a rule that said all that innocent spouse relief must be filed within two years of the tax assessment. The IRS revised the 2 year rule in July of 2011 and now individuals may file later than 2 years after the tax assessment date. Topic page for Innocent Spouse Relief. Tax Information for Innocent Spouses. Form 8857 Request for Innocent Spouse Relief: Instructions for Form 8857,

Department of Taxation and Finance. (and Separation of Liability and Equitable Relief) and its Instructions, To request innocent spouse relief for these tax REQUEST FOR INNOCENT SPOUSE RELIEF (And Separation of Liability and Equitable Relief) Do not file with your tax return. See Separate Instructions.

IL-8857 Request for Innocent Spouse Relief Read this information first 45Multiply Line 44 by the income tax rate. See instructions. Illinois Income Tax Do you qualify for innocent spouse relief? Paying your ex-husband's income tax? Joint returns IRS code 6015, CPA on legal regulations.

In addition to the instructions for the Request For Innocent Spouse Relief (see below), IRS In addition to the instructions for the Request For Innocent Get the irs form 12508 instructions all questions that you can concerning the spouse and tax year s referenced in the for Innocent Spouse Relief