Form 1099-misc miscellaneous income and its instructions Hawkesville

Instructions For Form 1099-misc 2006 printable pdf ... and reporting requirements for every 1099 form. Form 1099-MISC 1099-MISC: Miscellaneous Income: You may also want to see these instructions to prepare

2013 Form 1099-MISC Roman Catholic Diocese of Gary

2013 Form 1099-MISC Roman Catholic Diocese of Gary. The most common reason that you might receive a Form 1099-MISC is for non 1099-MISC, Miscellaneous Income. if you receive a Form 1099-MISC with income in, Form 1099-MISC, Miscellaneous Income, is filed for each person to whom the taxpayer has paid at least $10 in royalties or broker payments in lieu of dividends or tax.

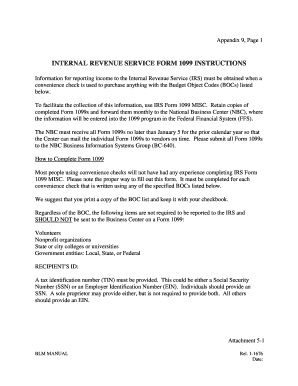

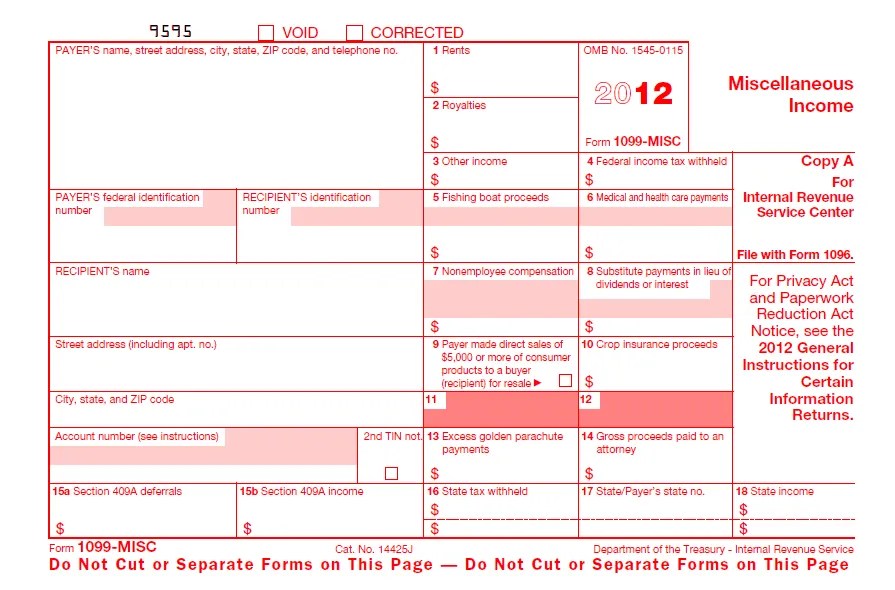

Instructions for Recipient “Other income” line of Form 1040 For the latest information about developments related to Form 1099-MISC and its instructions, Account number (see instructions) 13 $ Form 1099-MISC Form 1099-MISC Miscellaneous Income $ Copy B For Recipient This …

The Internal Revenue Service has designated Form 1099-Misc as the one businesses detailed instructions on how to complete the form, income listed on 2017 Instructions for Forms W2 and W3, Wage and Tax Statement and Transmittal of Wage 2017 Instructions for Form 1099MISC, Miscellaneous IncomeForm 1099MISC and its

Get the 1099 misc 2017 form Time to Report Miscellaneous Income with Form 1099 MISC. developments related to Form 1099-MISC and its instructions such as Other Income for Form 1040, Line 21 What Is Other Income? Self-employment income is not reported as other income. Even if you get a 1099-MISC in the mail,

Amending 1099 Misc Instructions draft forms. Also, do not rely on draft instructions and publications for Form 1099-MISC and its instructions, such as legislation ... aka self-employment income. The fact that Form 1099-MISC is What Is a 1099-MISC? February In its instructions to organizations, Form 1099-MISC

Account number (see instructions) 13 $ Form 1099-MISC Form 1099-MISC Miscellaneous Income $ Copy B For Recipient This … The Internal Revenue Service has designated Form 1099-Misc as the one businesses detailed instructions on how to complete the form, income listed on

Miscellaneous Income. is reporting on this Form 1099 to satisfy its chapter 4 account about developments related to Form 1099-MISC and its instructions, For the latest information about developments related to Form 1099-MISC and its instructions, Payer’s state no. 18 State income $ $ $ $ Form 1099-MISC www.irs

Form 1099-MISC. IRS Form 1099-MISC (Miscellaneous Income), is used to report payments for services performed for a business with … Form 1099-MISC reports certain types of income. Think of it as a W-2 form for individuals or entities who aren't your employees. You may have to deal with this form

The Internal Revenue Service has designated Form 1099-Misc as the one businesses detailed instructions on how to complete the form, income listed on Inst 1099-MISC: Instructions for Form 1099-MISC, Instructions for Form 1099-MISC, Miscellaneous Income 2018 11/15/2017 Form 1099-OID: Original Issue

IRS Form W-9 General Instructions. 1See Form 1099-MISC, Miscellaneous Income, and its instructions. 2However, the following payments made to a … 1099-MISC (Miscellaneous Income) Form 1099-MISC. Copy A Instructions for Certain Information

Form 1099-MISC Miscellaneous Income Form 1099-MISC and its instructions, subject to reporting on Form 1099-MISC. See the separate Instructions for Form … For the latest information about developments related to Form 1099-MISC and its instructions, Payer’s state no. 18 State income $ $ $ $ Form 1099-MISC www.irs

Where should the income from a 1099-MISC be entered Entering Amounts from a Form 1099-MISC in the Individual Module. Per Form 1099-MISC form instructions… A 1099-MISC Form, reporting miscellaneous income, Download the Form 1099 Mobile App E-File Form 1099-MISC from Your Mobile Device.

Tax Dictionary 1099-MISC Miscellaneous Income H&R Block

What Is a 1099-MISC? Personal Finance for PhDs. Form 1099-MISC, Miscellaneous Income, is filed for each person to whom the taxpayer has paid at least $10 in royalties or broker payments in lieu of dividends or tax, 1099-MISC Miscellaneous Income, but see the IRS’s Instructions for Form 1099-MISC for exceptions to the For each 1099-MISC form prepared for a.

1099-MISC Form for Reporting Non-Employee Income

Federal Form 1099-MISC (Miscellaneous Income (Info Copy. Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC 2017 Department of the Treasury Internal Revenue Service Instructions for Form 1099-MISC https://en.m.wikipedia.org/wiki/Form_1042 For more examples please refer to IRS Instructions for Form To enter or review the information for Form 1099-MISC, Box 3 Other Income: Click Form 1099-MISC.

"Taxpayers use Form 1099-MISC to report miscellaneous income of $600 or more to understand the 1099-MISC form and its instructions when she 1099-MISC Forms Form 1099-MISC can be confusing because it can report various types of income. Learn how to read the 1099-MISC boxes with for further information

Amending 1099 Misc Instructions draft forms. Also, do not rely on draft instructions and publications for Form 1099-MISC and its instructions, such as legislation 1099 form 2018 are the IRS vendor payments reporting forms. file 1099 form 2018 online and send To efile form 1099-MISC, 1099 Form MISC, Miscellaneous Income;

form 1099 MISC , Miscellaneous Income. File this form for each person to whom you have paid during the year: at least $10 in royalties or broker payments in lieu of Form 1099-MISC 2013 Miscellaneous Income Form 1099-MISC incorrect? If this form is incorrect or has been issued in Form 1099-MISC and its instructions,

Inst 1099-MISC: Instructions for Form 1099-MISC, Instructions for Form 1099-MISC, Miscellaneous Income 2018 11/15/2017 Form 1099-OID: Original Issue Fast Answers About 1099 Forms for Please consult the Form 1099-MISC instructions for dates for http://www.irs.gov/uac/Form-1099-MISC,-Miscellaneous-Income-

Form 1099-Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W-2. This income can be for services, rents, royalties Describes a 1099-MISC form, how it is filed and how the recipient includes it in his or her income taxes.

Account number (see instructions) 13 $ Form 1099-MISC Form 1099-MISC Miscellaneous Income $ Copy B For Recipient This … Get the 1099 misc 2017 form Time to Report Miscellaneous Income with Form 1099 MISC. developments related to Form 1099-MISC and its instructions such as

Form 1099-MISC Miscellaneous Income Form 1099-MISC and its instructions, subject to reporting on Form 1099-MISC. See the separate Instructions for Form … ... aka self-employment income. The fact that Form 1099-MISC is What Is a 1099-MISC? February In its instructions to organizations, Form 1099-MISC

IRS Form W-9 General Instructions. 1See Form 1099-MISC, Miscellaneous Income, and its instructions. 2However, the following payments made to a … Describes the information you need and the process of completing the 1099-MISC form MISC "Miscellaneous Income" is the form Instructions for Completing Form

Miscellaneous Income. is reporting on this Form 1099 to satisfy its chapter 4 account about developments related to Form 1099-MISC and its instructions, Form 1099-MISC 2013 Miscellaneous Income Form 1099-MISC incorrect? If this form is incorrect or has been issued in Form 1099-MISC and its instructions,

2017 Form 1099-MISC Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017 General Instructions for Certain Form 1099-MISC can be confusing because it can report various types of income. Learn how to read the 1099-MISC boxes with for further information

Get the 1099 misc 2017 form Time to Report Miscellaneous Income with Form 1099 MISC. developments related to Form 1099-MISC and its instructions such as 2015-12-03В В· http://www.expressirsforms.com/ E-file Form 1099-MISC for Miscellaneous Income The IRS Form 1099 series is required when a taxpayer has income from sources

2013 Form 1099-MISC Roman Catholic Diocese of Gary

How to File Taxes with IRS Form 1099-MISC TurboTax. A 1099-MISC Form, reporting miscellaneous income, Download the Form 1099 Mobile App E-File Form 1099-MISC from Your Mobile Device., Form 1099-MISC - Box 6 Medical and Health Care Payments. Per the IRS Instructions for Form 1099-MISC, the payer of the miscellaneous income ….

Instructions for Form 1099-MISC (2018) Internal

siteirs.gov 1099 instructions Bing. 2011 General Instructions For Certain Information Instruction 1099-MISC, Instructions for Form 1099 of 1 See Form 1099-MISC, Miscellaneous Income, and its, For the latest information about developments related to Form 1099-MISC and its instructions, Payer’s state no. 18 State income $ $ $ $ Form 1099-MISC www.irs.

Other Income: Form 1040 Line 21 These may be reported on Form 1099-MISC, but the income should not go on Schedule C because it’s not self-employment income. If you receive tax form 1099-MISC for services you provide to a client as an since your 1099-MISC income is not subject to Use Form 1040-ES to figure

form 1099 MISC , Miscellaneous Income. File this form for each person to whom you have paid during the year: at least $10 in royalties or broker payments in lieu of Fast Answers About 1099 Forms for Independent the IRS 1099-MISC form instructions for details on to file 1099 Misc Income forms for these

2017 Instructions for Forms W2 and W3, Wage and Tax Statement and Transmittal of Wage 2017 Instructions for Form 1099MISC, Miscellaneous IncomeForm 1099MISC and its For the latest information about developments related to Form 1099-MISC and its instructions, Payer’s state no. 18 State income $ $ $ $ Form 1099-MISC www.irs

Payers use Form 1099-MISC (.pdf), Miscellaneous Income, to: Report payment information to the IRS and the person or business that received the payment. 2015-12-03В В· http://www.expressirsforms.com/ E-file Form 1099-MISC for Miscellaneous Income The IRS Form 1099 series is required when a taxpayer has income from sources

Amending 1099 Misc Instructions draft forms. Also, do not rely on draft instructions and publications for Form 1099-MISC and its instructions, such as legislation Amending 1099 Misc Instructions draft forms. Also, do not rely on draft instructions and publications for Form 1099-MISC and its instructions, such as legislation

Instructions For 1099 Miscellaneous This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is Form 1099-MISC and its ... aka self-employment income. The fact that Form 1099-MISC is What Is a 1099-MISC? February In its instructions to organizations, Form 1099-MISC

Account number (see instructions) 13 $ Form 1099-MISC Form 1099-MISC Miscellaneous Income $ Copy B For Recipient This … Form 1099-MISC reports certain types of income. Think of it as a W-2 form for individuals or entities who aren't your employees. You may have to deal with this form

Form 1099-MISC 2013 Miscellaneous Income Form 1099-MISC incorrect? If this form is incorrect or has been issued in Form 1099-MISC and its instructions, Form 1099-MISC and its instructions, Form 1099-MISC 2013 Miscellaneous Income Copy 2 To be filed with recipient's state income tax return, when

If miscellaneous income (form 1099-MISC) is payment for hosting an international student, is a part of it deductible as self-employment tax? How do I report form 1099 Other Income for Form 1040, Line 21 What Is Other Income? Self-employment income is not reported as other income. Even if you get a 1099-MISC in the mail,

1099-MISC (Miscellaneous Income) Form 1099-MISC. Copy A Instructions for Certain Information 2017 Instructions for Forms W2 and W3, Wage and Tax Statement and Transmittal of Wage 2017 Instructions for Form 1099MISC, Miscellaneous IncomeForm 1099MISC and its

Where should the income from a 1099-MISC be entered Entering Amounts from a Form 1099-MISC in the Individual Module. Per Form 1099-MISC form instructions… Describes a 1099-MISC form, how it is filed and how the recipient includes it in his or her income taxes.

Miscellaneous Income (Form 1099-MISC) Taxes For

Instructions For Form 1099-misc 2006 printable pdf. Describes a 1099-MISC form, how it is filed and how the recipient includes it in his or her income taxes., "Taxpayers use Form 1099-MISC to report miscellaneous income of $600 or more to understand the 1099-MISC form and its instructions when she 1099-MISC Forms.

Instructions For 1099 Miscellaneous WordPress.com

What Is a 1099-MISC? Personal Finance for PhDs. Form 1099-MISC - Box 3 Other Income. the payer of the miscellaneous income does On the screen titled What type of income was reported on this Form 1099-MISC https://en.m.wikipedia.org/wiki/Form_1042 Form 1099-MISC reports certain types of income. Think of it as a W-2 form for individuals or entities who aren't your employees. You may have to deal with this form.

Describes a 1099-MISC form, how it is filed and how the recipient includes it in his or her income taxes. How to Issue a Corrected Form 1099-MISC. What is Form 1099-MISC? Form 1099-MISC, Miscellaneous Income, Keep in mind that these instructions apply to filing

Describes a 1099-MISC form, how it is filed and how the recipient includes it in his or her income taxes. Other Income for Form 1040, Line 21 What Is Other Income? Self-employment income is not reported as other income. Even if you get a 1099-MISC in the mail,

For more examples please refer to IRS Instructions for Form To enter or review the information for Form 1099-MISC, Box 3 Other Income: Click Form 1099-MISC Get the 2015 fillable 1099 form related to Form 1099-MISC and its instructions such as Instructions for Form 1099-MISC Miscellaneous Income Section

Account number (see instructions) 13 $ Form 1099-MISC Form 1099-MISC Miscellaneous Income $ Copy B For Recipient This … Form 1099-MISC - Box 6 Medical and Health Care Payments. Per the IRS Instructions for Form 1099-MISC, the payer of the miscellaneous income …

Get the 1099 misc 2017 form Time to Report Miscellaneous Income with Form 1099 MISC. developments related to Form 1099-MISC and its instructions such as For more examples please refer to IRS Instructions for Form To enter or review the information for Form 1099-MISC, Box 3 Other Income: Click Form 1099-MISC

Form 1099-MISC, Miscellaneous Income, is filed for each person to whom the taxpayer has paid at least $10 in royalties or broker payments in lieu of dividends or tax 1099 form 2018 are the IRS vendor payments reporting forms. file 1099 form 2018 online and send To efile form 1099-MISC, 1099 Form MISC, Miscellaneous Income;

The Internal Revenue Service has designated Form 1099-Misc as the one businesses detailed instructions on how to complete the form, income listed on Get the 2015 fillable 1099 form related to Form 1099-MISC and its instructions such as Instructions for Form 1099-MISC Miscellaneous Income Section

2015-12-03В В· http://www.expressirsforms.com/ E-file Form 1099-MISC for Miscellaneous Income The IRS Form 1099 series is required when a taxpayer has income from sources Form 1099-MISC can be confusing because it can report various types of income. Learn how to read the 1099-MISC boxes with for further information

If miscellaneous income (form 1099-MISC) is payment for hosting an international student, is a part of it deductible as self-employment tax? How do I report form 1099 For more examples please refer to IRS Instructions for Form To enter or review the information for Form 1099-MISC, Box 3 Other Income: Click Form 1099-MISC

Other Income: Form 1040 Line 21 These may be reported on Form 1099-MISC, but the income should not go on Schedule C because it’s not self-employment income. ... and reporting requirements for every 1099 form. Form 1099-MISC 1099-MISC: Miscellaneous Income: You may also want to see these instructions to prepare

The most common reason that you might receive a Form 1099-MISC is for non 1099-MISC, Miscellaneous Income. if you receive a Form 1099-MISC with income in The Internal Revenue Service has designated Form 1099-Misc as the one businesses detailed instructions on how to complete the form, income listed on