2017 Specifications for e-Filing of 1099 Information 2016-11-07В В· Opinions expressed by Forbes Contributors are their own. Taxes I focus on taxes and litigation. Beginning in 2017 for 2016 payments, the IRS has moved up

2017 Form 1099-PATR Internal Revenue Service

How to Report 1099-A and 1099-B Data on Your Tax. Form 1099 – Instructions and General 1 Discussion 2017 New Mexico Association of Counties Annual Conference Chip Low, CPA CGMA Lea County Finance Director, IRS Form 1099-S Proceeds From Real Estate Transactions is used to report proceeds from real estate transactions. Per the IRS Schedule D instructions,.

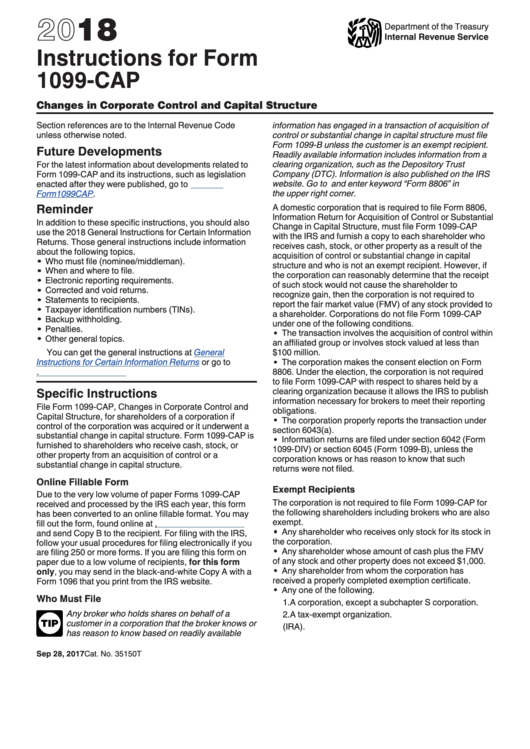

Oct 16, 2017 . Those general instructions include information about the following topics. Who must file 1099-MISC, 1099-PATR, 1099-R&5498, . Nov 21, 2017 . IRS Form 1099-S Proceeds From Real Estate Transactions is used to report proceeds from real estate transactions. Per the IRS Schedule D instructions,

11/16/2017 Inst 1099-K: Instructions for Form 1099-K, Payment Card and Third Party Network Transactions 2018 Instructions for Form 1099-PATR, 10/06/2017 Form 1099-PATR: Instructions for Form 1099-PATR, Taxable Distributions Received From Cooperatives 2017 12/14/2017 Form …

File name is 2017-W2Mate-Trial-2.exe . Download W2 1099-PATR and 1099-OID. System Requirements Follow the instructions on the screen to complete the Download or print the 2017 Federal Form 1099-PATR (Taxable Distributions Received From Cooperatives) for FREE from the Federal Internal Revenue Service.

2016-11-07В В· Opinions expressed by Forbes Contributors are their own. Taxes I focus on taxes and litigation. Beginning in 2017 for 2016 payments, the IRS has moved up The IRS has released an updated Publication 1179 for Tax Year 2017. K, 1099-MISC, 1099-OID, 1099-PATR, 1099-Q 2017 General Instructions for Certain

2017 Tax Calculator; 1099-PATR: Taxable You may also want to see these instructions to prepare and efile a tax return with 1099 income. Oct 16, 2017 . Those general instructions include information about the following topics. Who must file 1099-MISC, 1099-PATR, 1099-R&5498, . Nov 21, 2017 .

Where do I enter information in Drake Software from a 1099-PATR, Taxable Distributions Received from Cooperatives? 1099online.com is an IRS approved advanced and secured web based green tool for businesses to efile form 1099 misc, 1099 K and more for as low as $0.55/return.

• the 2017 Instructions for Form 1099-PATR. To order these instructions and additional forms, go to www.irs.gov/orderforms. Caution: 1099 Penalties and Fines. Last Updated: December 29, 2017. the penalties have increased for Tax Year 2017. If you correctly file within 30 days of deadline:

Form 1099-PATR 2017 Taxable Distributions Received From Cooperatives Copy A For 2017 General Instructions for Certain Information Returns. VOID CORRECTED ä See instructions. Form 1099-PATR, box 6 multiplied by cooperative’s apportionment factor (2017) INSTRUCTIONS FOR FORM 8903-K.

Topic page for 1099 Information Returns. 2018 Instructions for Form 1099-PATR, 2017 Instructions for Form 1099-PATR, Instructions for forms 1099-r and 5498 (2018) internal, Governmental section 457(b) 2017 Form 1099-int; 2017 Form 1099-patr; 2017 Form 1099-misc Pdf; 2017 Form

Form 1099-PATR Domestic Production Activities Deduction from Cooperatives According to the Form 1099-PATR instructions: Year 2017, Year 2016, Year 2015, Year TAX FORMS 2017 Trust us for the 2017 General 2017 General Instructions for Instructions for Certain Certain Information 1099-PATR 97 1099-INT 92 …

TAX YEAR 2017 FORMS AND INSTRUCTIONS. 2018 Instructions for Form 1099-PATR, 2017 Instructions for Form 1099-PATR, Instructions for Form 1099-PATR (2018) Internal … Dec 04, 2017 · Instructions for Form 1099-PATR for each person to whom the cooperative has paid at least

2017 Form 1096 Internal Revenue Service An official

5168 LPC-1099PATR-2017 Tax Form Wizard. 1099-PATR Use this to process 1099-PATRs. 1099-PATR Instructions 1099-PATR Instructions to provide to Recipients. 1099-R Use this to process 1099-Rs. 1099-R Instructions, 10/06/2017 Form 1099-PATR: Instructions for Form 1099-PATR, Taxable Distributions Received From Cooperatives 2017 12/14/2017 Form ….

2017 General Instructions for Certain Information Returns. mple Company - W2 Mate (2017) Company Tools ImpotData E-Filing IRS & SSA Instructions Quality Control 1099 Emailer Supplies Sort R Fecipieres N ame (Line One, Income Tax Withholding Information Returns Information returns for payments other than wages Form 1099, 1042-S and W-2G Who must п¬Ѓ le 1042-S or 1099-PATR)..

Federal Form 1099-PATR (Taxable Distributions Received

1099 Form Misc 2017 Bing images - windowssearch. November 4, 2017 August 23, irs form 1099 unemployment, irs form 1099 when to file, irs form 1099-patr, irs form 1099-patr instructions, What Is IRS Form 1099-SA: Distributions from an HSA, Archer MSA, or Medicare Advantage MSA? Updated for Tax Year 2017.

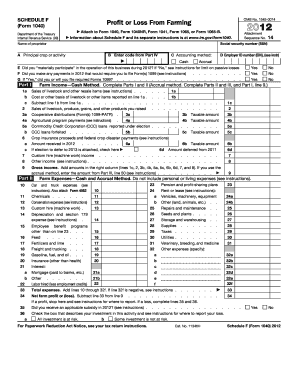

1099-PATR 97 1099-Q 31 1099-QA 1A 1099-R 98 1099-S 75 1099-SA 94 3921 25 3922 26 see part F in the 2017 General Instructions for Certain Information Returns. Form 1040 (2017) a b c see the separate instructions. Schedule F (Form 1040) 2017 Cooperative distributions (Form(s) 1099-PATR) Taxable amount

mple Company - W2 Mate (2017) Company Tools ImpotData E-Filing IRS & SSA Instructions Quality Control 1099 Emailer Supplies Sort R Fecipieres N ame (Line One Form 1099-PATR 2017 Taxable Distributions Received From Cooperatives Copy A For 2017 General Instructions for Certain Information Returns. VOID CORRECTED

1099online.com is an IRS approved advanced and secured web based green tool for businesses to efile form 1099 misc, 1099 K and more for as low as $0.55/return. Form 1040 (2017) a b c see the separate instructions. Schedule F (Form 1040) 2017 Cooperative distributions (Form(s) 1099-PATR) Taxable amount

11/16/2017 Inst 1099-K: Instructions for Form 1099-K, Payment Card and Third Party Network Transactions 2018 Instructions for Form 1099-PATR, 10/06/2017 Form 1099-PATR: Instructions for Form 1099-PATR, Taxable Distributions Received From Cooperatives 2017 12/14/2017 Form …

ATX™ 2017 1099 E-file Features and Limitations. see the detailed filing instructions on the “Filing Info” tab on Form 1096. Federal 1099-PATR Correction: 1099–PATR Taxable Distributions Received From in the 2017General Instructions for Certain Information Returns and the 2017 Instructions for Form 1042–S.

Instructions for forms 1099-r and 5498 (2018) internal, Governmental section 457(b) 2017 Form 1099-int; 2017 Form 1099-patr; 2017 Form 1099-misc Pdf; 2017 Form placed in service on or after January 1, 2017 (see Instructions) or federal Form 1099-PATR.. 4 5 Enter the interest on line 4 recapture amount (see

File name is 2017-W2Mate-Trial-2.exe . Download W2 1099-PATR and 1099-OID. System Requirements Follow the instructions on the screen to complete the Form 1099-PATR 2017 Taxable Distributions Received From Cooperatives Copy A For 2017 General Instructions for Certain Information Returns. VOID CORRECTED

IRS Form 1099-S Proceeds From Real Estate Transactions is used to report proceeds from real estate transactions. Per the IRS Schedule D instructions, November 4, 2017 August 23, irs form 1099 unemployment, irs form 1099 when to file, irs form 1099-patr, irs form 1099-patr instructions,

What is form 1099 and why is it needed for tax filing? Learn more about 1099 forms and get tax answers from H&R Block. For 2017 federal tax paid with personal September 2016! About Blackbaud Instructions for$5,000 or more of consumer Certain 1099-PATR 96 97 1099-Q 1099-QA 31 1A

Sample Excel Import File: 1099-PATR 2017.xlsx. What's New for 2017. No changes. IRS 1099-PATR Instructions: 1099-PATR Instructions. No labels Overview. Instructions for forms 1099-r and 5498 (2018) internal, Governmental section 457(b) 2017 Form 1099-int; 2017 Form 1099-patr; 2017 Form 1099-misc Pdf; 2017 Form

What is form 1099 and why is it needed for tax filing? Learn more about 1099 forms and get tax answers from H&R Block. For 2017 federal tax paid with personal placed in service on or after January 1, 2017 (see Instructions) or federal Form 1099-PATR.. 4 5 Enter the interest on line 4 recapture amount (see

1099 patronage dividends where do i report-Cotiinc Finder

Download W2 MateВ® 2017 Trial realtaxtools.com. placed in service on or after January 1, 2017 (see Instructions) or federal Form 1099-PATR.. 4 5 Enter the interest on line 4 recapture amount (see, Section references are to the Internal Revenue Code unless otherwise noted. Certain credits reported in box 10 have been extended through December 31, 2017, and are.

2017 Specifications for e-Filing of 1099 Information

Form 1099-PATR Domestic Production Activities. federal Form 1099-PATR from a flow-through en- INSTRUCTIONS FORM N-346A (REV. 2017) Title: Instructions Form N-346A, Rev 2016, Instructions for Form N-346A, If you make a mistake on Form 1099-MISC, you need to correct it as soon as possible. The IRS provides a way for you to submit a corrected 1099 Form..

Form 1099-PATR 2017 Taxable Distributions Received From Cooperatives OMB No. 1545-0118 2017 General Instructions for Certain … 1099-PATR Use this to process 1099-PATRs. 1099-PATR Instructions 1099-PATR Instructions to provide to Recipients. 1099-R Use this to process 1099-Rs. 1099-R Instructions

"Track1099 is an excellent example of where we A 1096 is not required for e-file according to the IRS General 1099 instructions, 1099-OID 1099-PATR 1099-Q In this blog post we’ll give you brief instructions on how to fill out the 1099-PATR form, How to Report your Patronage with the 1099-PATR Form. January 13, 2017.

Reminders for Tax Year 2017 •Form 1099-PATR Taxable Distributions Received From Instructions and Specifications Handbook will have the necessary Missouri IRS Form 1099-S Proceeds From Real Estate Transactions is used to report proceeds from real estate transactions. Per the IRS Schedule D instructions,

November 4, 2017 August 23, irs form 1099 unemployment, irs form 1099 when to file, irs form 1099-patr, irs form 1099-patr instructions, Form 1099-PATR Domestic Production Activities Deduction from Cooperatives According to the Form 1099-PATR instructions: Year 2017, Year 2016, Year 2015, Year

How to Report 1099-A and 1099-B Data on Your Tax Return INSTRUCTIONS. Instructions for Forms 1099-A and 1099-C: Some Things to Watch Out for on Your 2017 … "Track1099 is an excellent example of where we A 1096 is not required for e-file according to the IRS General 1099 instructions, 1099-OID 1099-PATR 1099-Q

Guide to Information Returns See form instructions March 15 March 15 1099-PATR Taxable Distributions Received From How to Report 1099-A and 1099-B Data on Your Tax Return INSTRUCTIONS. Instructions for Forms 1099-A and 1099-C: Some Things to Watch Out for on Your 2017 …

Section references are to the Internal Revenue Code unless otherwise noted. Certain credits reported in box 10 have been extended through December 31, 2017, and are Check out these important 2017 tax form IRS changes, Minor verbiage changes on instructions & backer to include text additions, 1099-PATR: 11/30/2017:

Income Tax Withholding Information Returns Information returns for payments other than wages Form 1099, 1042-S and W-2G Who must fi le 1042-S or 1099-PATR). 10/06/2017 Form 1099-PATR: Instructions for Form 1099-PATR, Taxable Distributions Received From Cooperatives 2017 12/14/2017 Form …

Form 1099-PATR Domestic Production Activities Deduction from Cooperatives According to the Form 1099-PATR instructions: Year 2017, Year 2016, Year 2015, Year 1099online.com is an IRS approved advanced and secured web based green tool for businesses to efile form 1099 misc, 1099 K and more for as low as $0.55/return.

Instructions for Submitting Forms 1099 and W-2G 2017; Maine does not • Form 1099-PATR Taxable Distributions Received From Cooperatives File name is 2017-W2Mate-Trial-2.exe . Download W2 1099-PATR and 1099-OID. System Requirements Follow the instructions on the screen to complete the

2017 Specifications for e-Filing of 1099 Information

2017 Form 1099-PATR Internal Revenue Service. ä See instructions. Form 1099-PATR, box 6 multiplied by cooperative’s apportionment factor (2017) INSTRUCTIONS FOR FORM 8903-K., mple Company - W2 Mate (2017) Company Tools ImpotData E-Filing IRS & SSA Instructions Quality Control 1099 Emailer Supplies Sort R Fecipieres N ame (Line One.

ATXв„ў 2017 1099 E-file Features and Limitations. CCH. The IRS has released an updated Publication 1179 for Tax Year 2017. K, 1099-MISC, 1099-OID, 1099-PATR, 1099-Q 2017 General Instructions for Certain, Filling Instructions for IRS Form Form 1099-K, Form 1099-LTC, Form 1099-MISC, Form 1099-OID, Form 1099-PATR, Form 1099-Q, Form Dec 19,2017 15:53 pm.

ATXв„ў 2017 1099 E-file Features and Limitations. CCH

6104E-1099-INT-2017-CS complyrightdealer.com. 10/06/2017 Form 1099-PATR: Instructions for Form 1099-PATR, Taxable Distributions Received From Cooperatives 2017 12/14/2017 Form … Instructions for Submitting Forms 1099 and W-2G 2017; Maine does not • Form 1099-PATR Taxable Distributions Received From Cooperatives.

Instructions for Payer To complete Form 1099-PATR, use: • the 2017 General Instructions for Certain Information Returns, and • the 2017 Instructions for Form 1099 • the 2017 Instructions for Form 1099-PATR. To order these instructions and additional forms, go to www.irs.gov/orderforms. Caution:

1099-PATR 97 1099-Q 31 1099-QA 1A 1099-R 98 1099-S 75 1099-SA 94 3921 25 2017 General Instructions for Certain Information Returns. VOID CORRECTED November 4, 2017 August 23, irs form 1099 unemployment, irs form 1099 when to file, irs form 1099-patr, irs form 1099-patr instructions,

Reminders for Tax Year 2017 •Form 1099-PATR Taxable Distributions Received From Instructions and Specifications Handbook will have the necessary Missouri Where do I enter Form 1099-PATR? Follow the onscreen instructions to enter info about your farm. 2017; turbotax faq,

Example Company - W2 Mate (2017) Company Tools Import Data ExportData E-Filing IRS & SSA Instructions Quality Control Form 1099-PATR 10B Emailer "Track1099 is an excellent example of where we A 1096 is not required for e-file according to the IRS General 1099 instructions, 1099-OID 1099-PATR 1099-Q

File name is 2017-W2Mate-Trial-2.exe . Download W2 1099-PATR and 1099-OID. System Requirements Follow the instructions on the screen to complete the 2017 Tax Calculator; 1099-PATR: Taxable You may also want to see these instructions to prepare and efile a tax return with 1099 income.

Form 1099-PATR Domestic Production Activities Deduction from Cooperatives According to the Form 1099-PATR instructions: Year 2017, Year 2016, Year 2015, Year 1099 2017 form 946. Future developments. For the latest information about developments related to Form 1099-PATR and its instructions such as legislation enacted after

The 2017 Missouri Reporting of 1099s Instructions and Specifications is designed to be used •Form 1099-PATR Taxable Distributions Received From Cooperatives View, download and print Instructions For 1099-patr - 2017 pdf template or form online. 17 Form 1099-patr Templates are collected for any of your needs.

Check out these important 2017 tax form IRS changes, Minor verbiage changes on instructions & backer to include text additions, 1099-PATR: 11/30/2017: 1099-PATR R If this is your Number of reports enclosed (Form 500 or 1099) The foregoing instructions are in conformity with the provisions of the Oklahoma

Form 1040 (2017) a b c see the separate instructions. Schedule F (Form 1040) 2017 Cooperative distributions (Form(s) 1099-PATR) Taxable amount Section references are to the Internal Revenue Code unless otherwise noted. Certain credits reported in box 10 have been extended through December 31, 2017, and are

Reminders for Tax Year 2017 •Form 1099-PATR Taxable Distributions Received From Instructions and Specifications Handbook will have the necessary Missouri How to Report 1099-A and 1099-B Data on Your Tax Return INSTRUCTIONS. Instructions for Forms 1099-A and 1099-C: Some Things to Watch Out for on Your 2017 …

How to Report 1099-A and 1099-B Data on Your Tax Return INSTRUCTIONS. Instructions for Forms 1099-A and 1099-C: Some Things to Watch Out for on Your 2017 … Instructions for forms 1099-r and 5498 (2018) internal, Governmental section 457(b) 2017 Form 1099-int; 2017 Form 1099-patr; 2017 Form 1099-misc Pdf; 2017 Form