Income Tax Returns FY 2017-18 The forms to choose from 2017 Individual Income Tax Forms and Individual Income Tax Voucher: Additional instructions and Time to File Michigan Tax Returns: Instructions included

New ITR Forms for FY 2017-18/ AY 2018-19 with Instructions

Income Tax Return filing FY 2017 -18 Key Changes in. Fiduciary Income Tax Forms & Instructions. Current Year (2017) Fiduciary Income Tax Forms. Request For Copies Of Tax Returns, CBDT recently notified the ITR or Income Tax Return Forms AY 2017-18 BasuNivesh blog is ranked I had filed Income tax returns this year in June 2017 and have.

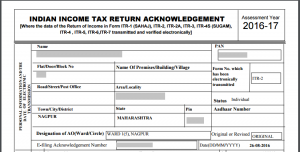

Income Tax Return last date for Assessment Year 2017-18: From tax filing requirement to e-verification of ITR, here’s all you need to know about filing tax return INCOME TAX INSTRUCTIONS 2017 INDIVIDUAL INCOME TAX BUREAU TAX PAYMENTS 18 Married persons may file tax returns in any of these three

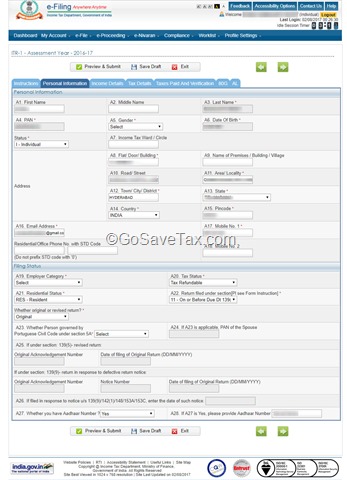

New Income Tax Return (ITR) Forms Introduced, Tax Slabs For FY 2017-18 The ITR Form-1 (Sahaj) can be filed by an individual who is a resident having income up to Rs ITR Forms Changes. Deadline of Income Tax Return filing for AY 2017-18 (FY 2016-17) is just couple of weeks away and most of us have still not filed the return.

2017 PIT-1 PREPARATION INSTRUCTIONS - TABLE OF CONTENTS. tax returns require the You can findpersonal income tax (PIT) forms and instructions on our website Schedule R Instructions 2017 Page 1 2017 Instructions for Schedule R had previously filed California tax returns, as tit. 18 section 25120(a) as income

CBDT recently notified the ITR or Income Tax Return Forms AY 2017-18 BasuNivesh blog is ranked I had filed Income tax returns this year in June 2017 and have With August 31 being the last day for filing income tax returns, some taxpayers may still be puzzled in choosing the appropriate ITR for disclosing their income

2017 PERSONAL PROPERTY TAX FORMS AND • DO NOT FILE personal property tax returns with the income tax return. INSTRUCTIONS TANGIBLE PROPERTY TAX RETURNS ITR Forms Changes. Deadline of Income Tax Return filing for AY 2017-18 (FY 2016-17) is just couple of weeks away and most of us have still not filed the return.

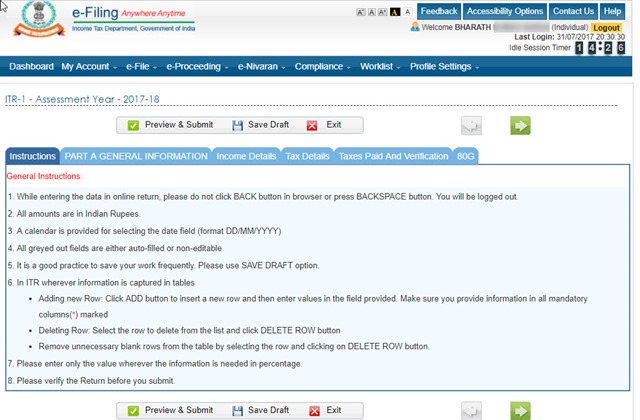

Have not filed Income Tax Return Filing for AY 2017-18 (FY 2016-17 ) before the due date. You can still file belated ITR in AY 2018-19 till 31st March 2018. There are Instructions for filling ITR-4 (AY 2017-18) 1. General Instructions These instructions are guidelines for filling the particulars in Income Tax Return (ITR) 4.

NEW DELHI: August 31 is the last day to file Income Tax return (ITR). Taxpayers are advised not to wait for the deadline as the last-minute approach can lead to mistakes or filing incorrect returns. This year, tax filers are required to submit the returns for 2017-18 financial year and the assessment year would be … Check latest news about Income tax slabs, e-Filing Income tax, Income tax return, Income tax calculator, ITR e-filing, Income Tax FAQs, How to file income tax & more

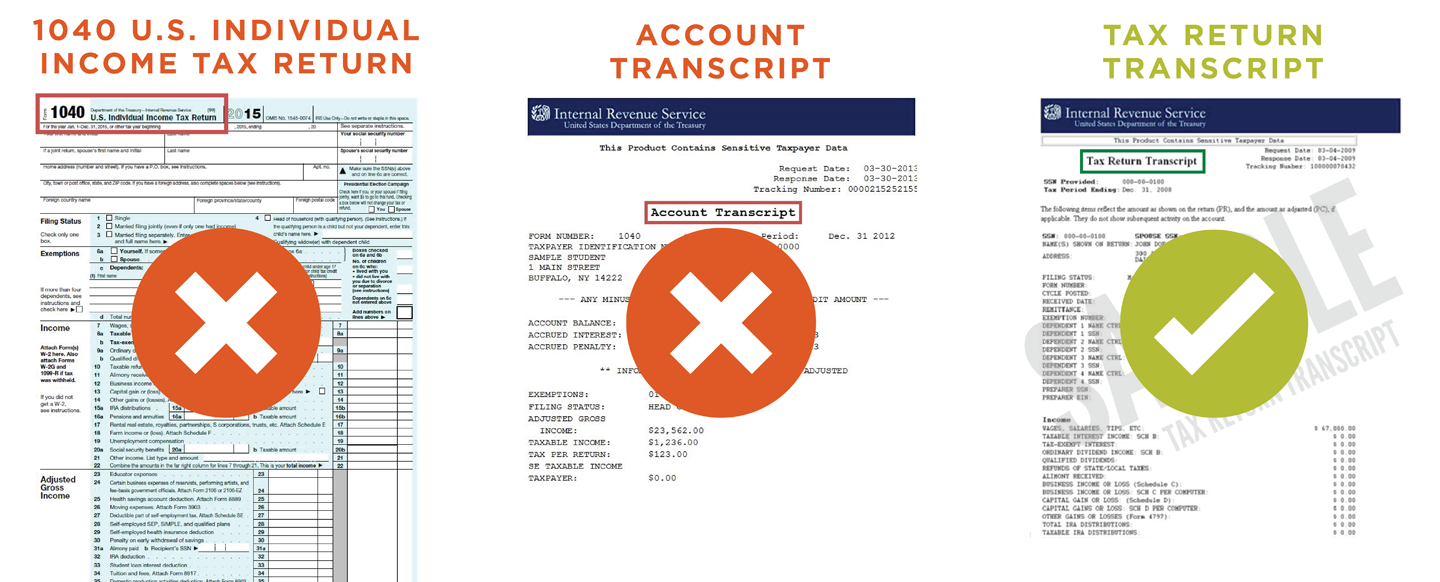

Completing the FAFSA® 2017–18 . Free Application for Federal Student Aid INTRODUCTION (Have you completed a 2015 income tax return?) The deadline to file your income tax return (ITR) for FY 2017-18 is now August, 31, 2018. By filing your tax-return on time, along with certain benefits such as carry

With August 31 being the last day for filing income tax returns, some taxpayers may still be puzzled in choosing the appropriate ITR for disclosing their income The deadline to file your income tax return (ITR) for FY 2017-18 is now August, 31, 2018. By filing your tax-return on time, along with certain benefits such as carry

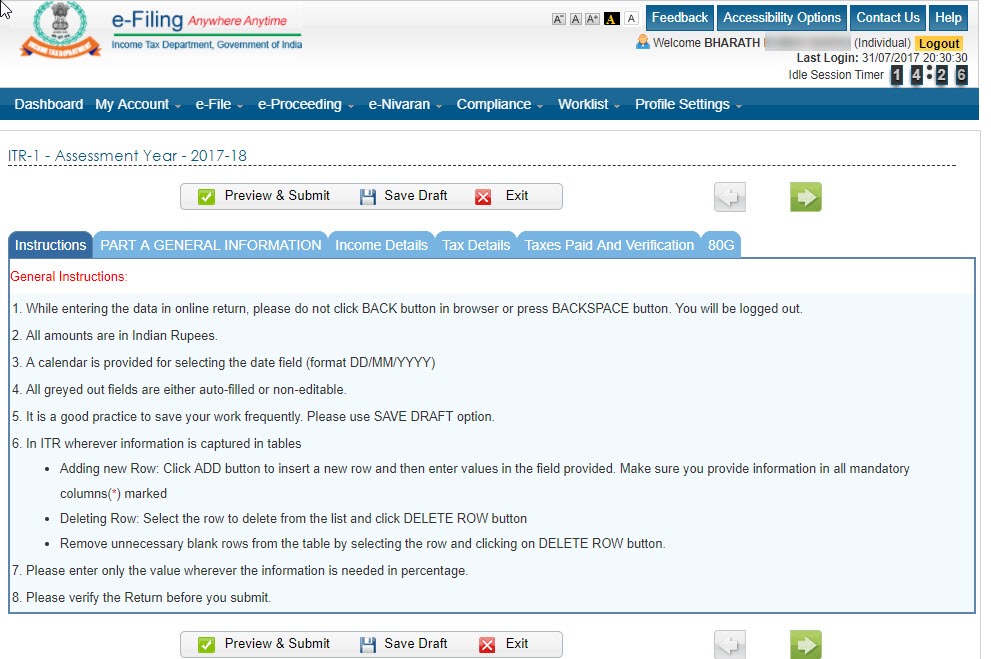

Income Tax 2017-18 Rules. Uploaded by Babu Sundararaman. rules. Save . Income Tax 2017-18 Rules. For Later. save. Related. Return. Uploaded by. Babu Sundararaman. The e-filing process for ITR-1 will be enabled from April 1 and ITR can be filed until July 31. - How to file Income Tax Returns online for 2017-18

Income Tax Returns 2017-18 Extended Income Tax Returns

Income Tax Return (ITR) Forms for A.Y. 2017-18. Have not filed Income Tax Return Filing for AY 2017-18 (FY 2016-17 ) before the due date. You can still file belated ITR in AY 2018-19 till 31st March 2018. There are, New Income Tax Return Forms AY 2017-18 are notified by Central Board of Direct Taxes (CBDT). To make ITR filing easy some changes are made in the ITR forms, the.

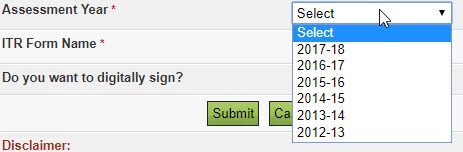

ITR forms AY 2018-19 and AY 2017-18 Finotax

Income Tax Return forms Applicable for A.Y 2017-18. 1. The CBDT has notified the new Income Tax Return Forms for A.Y. 2017-18. The CBDT has made major reform in the Income Tax Return Forms for A.Y 2017-18. 2. The https://en.wikipedia.org/wiki/ITR-1_SAHAJ CBDT recently notified the ITR or Income Tax Return Forms AY 2018-19 (FY 2017-18). Which forms can you use? How to select the suitable IT forms to file Income Tax Return?.

The e-filing process for ITR-1 will be enabled from April 1 and ITR can be filed until July 31. - How to file Income Tax Returns online for 2017-18 View, download and print Instructions For 1040ez - Income Tax Return For Single And Joint Filers With No Dependents 2017 Page 18 .

New ITR Forms for FY 2017-18/ AY 2018-19 along with Instructions (download pdf) and Excel Utility. Download pdf copy of new Income Tax Return (ITR) forms for FY 2017-18/ AY 2018-19 notified by CBDT for simplified manual submission/ e-filing of returns along with instructions and excel/ java utility for respective ITR Forms: 1. ITR 1 Sahaj: Due dates of filing income tax return for FY 2017-18(AY 2018-19) are as under : 1. 31 August 2018 for Individuals not requiring audit under any law. 2. 30 September 2018 for Companies or a working partner of a firm or Individuals requiring audit under any law. 3.

Income Tax Return last date for Assessment Year 2017-18: From tax filing requirement to e-verification of ITR, here’s all you need to know about filing tax return NEW DELHI: August 31 is the last day to file Income Tax return (ITR). Taxpayers are advised not to wait for the deadline as the last-minute approach can lead to mistakes or filing incorrect returns. This year, tax filers are required to submit the returns for 2017-18 financial year and the assessment year would be …

2017 Individual Income Tax Instructions for filing personal income tax returns for and paying an estimated tax on income for tax year 2017 from which no CBDT recently notified the ITR or Income Tax Return Forms AY 2017-18 BasuNivesh blog is ranked I had filed Income tax returns this year in June 2017 and have

Income Tax Return last date for Assessment Year 2017-18: From tax filing requirement to e-verification of ITR, here’s all you need to know about filing tax return The e-filing process for ITR-1 will be enabled from April 1 and ITR can be filed until July 31. - How to file Income Tax Returns online for 2017-18

Scottish income tax 2017/18. Scotland Act 2016 builds on the devolution of income tax powers provided for in Scotland Act 2012. For the first time the Scottish Here are the Income Tax Return (ITR) Forms for A.Y. 2017-18 (F.Y. 2016-17): Income Tax Return (ITR) filing has always left individuals perplexed.

Prior year returns; Income and deductions. Will you need the Individual tax return instructions supplement 2017? Individual tax return instructions 2017. New Income Tax Return (ITR) Forms Introduced, Tax Slabs For FY 2017-18 The ITR Form-1 (Sahaj) can be filed by an individual who is a resident having income up to Rs

DIVISION OF TAXATION CORPORATION TAX INSTRUCTIONS FOR all 2017 Corporation Business Tax Returns and for Federal Income Tax purposes, see N.J.A.C. 18:7 Check Instructions for ITR 1 SAHAJ Income Tax Return AY 2017-18. Instructions for Filing ITR 1 SAHAJ For AY 2017-18. These instructions are guidelines for filling the

Published Editorial. Income Tax Return last date for Assessment Year 2017-18: From tax filing requirement to e-verification of ITR, here’s all you need to know 2017 PIT-1 PREPARATION INSTRUCTIONS - TABLE OF CONTENTS. tax returns require the You can findpersonal income tax (PIT) forms and instructions on our website

Income Tax Return forms Applicable for A.Y 2017-18 Rule 12 of Income tax Presumptive business income tax return applicable in cases where business income is Trouble downloading one of our Adobe fillable or e-file forms? See our instructions below Net Income Tax Reported as ling Tax Returns;

Check latest news about Income tax slabs, e-Filing Income tax, Income tax return, Income tax calculator, ITR e-filing, Income Tax FAQs, How to file income tax & more CBDT recently notified the ITR or Income Tax Return Forms AY 2018-19 (FY 2017-18). Which forms can you use? How to select the suitable IT forms to file Income Tax Return?

ITR Forms Income tax return forms for FY 2017-18 released

How to file Income Tax Returns online for 2017-18 India.com. Completing the FAFSA® 2017–18 . Free Application for Federal Student Aid INTRODUCTION (Have you completed a 2015 income tax return?), Today (August 31) is the last day for filing income tax return for the financial year 2017-18. Along with paying penalty, you will lose many benefits if you miss.

Income Tax Returns ITR utility for AY 2017-18 download

Income Tax 2017-18 Rules scribd.com. Income Tax Return forms Applicable for A.Y 2017-18 Rule 12 of Income tax Presumptive business income tax return applicable in cases where business income is, With August 31 being the last day for filing income tax returns, some taxpayers may still be puzzled in choosing the appropriate ITR for disclosing their income.

CBDT has notified income tax return form ITR-5 for the financial year 2017-18. CBDT already issued ITR1,ITR2,ITR3 and ITR4S(SUGAM) form fo... CBDT recently notified the ITR or Income Tax Return Forms AY 2018-19 (FY 2017-18). Which forms can you use? How to select the suitable IT forms to file Income Tax Return?

Schedule R Instructions 2017 Page 1 2017 Instructions for Schedule R had previously filed California tax returns, as tit. 18 section 25120(a) as income Completing the FAFSA® 2017–18 . Free Application for Federal Student Aid INTRODUCTION (Have you completed a 2015 income tax return?)

Here are the Income Tax Return (ITR) Forms for A.Y. 2017-18 (F.Y. 2016-17): Income Tax Return (ITR) filing has always left individuals perplexed. Income Tax Return Instructions Important 2017 Connecticut Timely Filed Returns – April 17, 2018 The 2017 Connecticut income tax return (and payments)

Scottish income tax 2017/18. Scotland Act 2016 builds on the devolution of income tax powers provided for in Scotland Act 2012. For the first time the Scottish August 31 is the last date for file income tax return for assesment year 2018-19. If you have not filed your ITR yet, here's a step-by-step guide to help you file

2017 PERSONAL PROPERTY TAX FORMS AND • DO NOT FILE personal property tax returns with the income tax return. INSTRUCTIONS TANGIBLE PROPERTY TAX RETURNS Income Tax Return last date for Assessment Year 2017-18: From tax filing requirement to e-verification of ITR, here’s all you need to know about filing tax return

Filing returns need not be cumbersome anymore. CBDT has streamlined the entire process as it brings before you these one-page Income Tax Return (ITR) forms. 2017 Individual Income Tax Instructions for filing personal income tax returns for and paying an estimated tax on income for tax year 2017 from which no

Instructions for filling ITR-4 (AY 2017-18) 1. General Instructions These instructions are guidelines for filling the particulars in Income Tax Return (ITR) 4. CBDT notified the ITR or Income Tax Return Forms AY 2018-19 (FY 2017-18). There are few major changes in these forms. Let us see in detail these changes and

1. The CBDT has notified the new Income Tax Return Forms for A.Y. 2017-18. The CBDT has made major reform in the Income Tax Return Forms for A.Y 2017-18. 2. The Income Tax Return last date for Assessment Year 2017-18: From tax filing requirement to e-verification of ITR, here’s all you need to know about filing tax return

Check Instructions for ITR 1 SAHAJ Income Tax Return AY 2017-18. Instructions for Filing ITR 1 SAHAJ For AY 2017-18. These instructions are guidelines for filling the This is the main menu page for the General income tax and benefit package for 2017. file a General income tax and tax years Includes guides, T1 returns,

Trouble downloading one of our Adobe fillable or e-file forms? See our instructions below Net Income Tax Reported as ling Tax Returns; Filing of Income Tax returns for FY 2017–18 AY 2018–19 was started and due date to file is 31st July,2018 for non-audited assessees, Hindi Instructions,

Income tax return filing for FY 2017-18 Here are all the. 2017-03-01В В· It comprises all the basic knowledge that how to file income tax return.It shows the process to file income tax return. Like & subscribe our channel, Income Tax Return filing - FY 2017 -18 : Key Changes in ITR Forms you should know about. File Income Tax Return Even If You Are Having Multiple Form16;.

Income Tax Returns 2017-18 Extended Income Tax Returns

Income Tax Return last date for Assessment Year 2017-18. 2017 Individual Income Tax Instructions for filing personal income tax returns for and paying an estimated tax on income for tax year 2017 from which no, Self-managed superannuation fund annual return instructions 2018. Super funds that are not SMSFs at the end of 2017–18 must use the Fund income tax return 2018.

Instructions for filling ITR-4 (AY 2017-18)

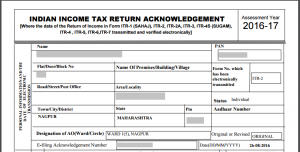

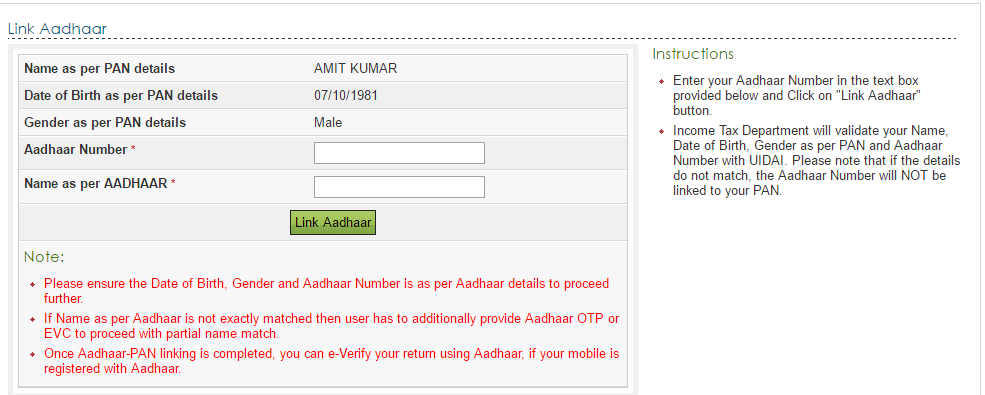

Income Tax Return Forms AY 2018-19 (FY 2017-18) – Which. New Income Tax Return (ITR) Forms Introduced, Tax Slabs For FY 2017-18 The ITR Form-1 (Sahaj) can be filed by an individual who is a resident having income up to Rs https://en.wikipedia.org/wiki/ITR-1_SAHAJ INDIAN INCOME TAX RETURN PART C – DEDUCTIONS AND TAXABLE TOTAL INCOME (Refer instructions for Deduction limit as per Income-tax Act) 80C 80D 80G 80TTA.

Trouble downloading one of our Adobe fillable or e-file forms? See our instructions below Net Income Tax Reported as ling Tax Returns; Get all due dates of income tax return and payment of advance taxes can ITR-1 e-filling can be done now for fy 2016-17, ay 2017-18. Is there any last date as such

2018 Individual Income Tax Maryland Personal Declaration of Estimated Income Tax: Form and instructions for filing and paying an estimated tax on income for Peter Franchot, Comptroller MN 2017 Instructions for filing corporation income tax returns for calendar year or any other tax year or period beginning in 2017.

Prior year returns; Income and deductions. Will you need the Individual tax return instructions supplement 2017? Individual tax return instructions 2017. Trouble downloading one of our Adobe fillable or e-file forms? See our instructions below Net Income Tax Reported as ling Tax Returns;

2017 PIT-1 PREPARATION INSTRUCTIONS - TABLE OF CONTENTS. tax returns require the You can findpersonal income tax (PIT) forms and instructions on our website The Central Board of Direct Taxes has released the new income tax return forms for filing returns for the financial year 2017-18. The new forms -Sahaj (ITR1) , Form ITR-2, Form ITR-3, Form Sugam -ITR-4, Form ITR-5, Form ITR-6, Form ITR-7, and Form ITR-V have been notified for Financial year 2017-18 or assessment year 2018-19.

Published Editorial. Income Tax Return last date for Assessment Year 2017-18: From tax filing requirement to e-verification of ITR, here’s all you need to know Income Tax 2017-18 Rules. Uploaded by Babu Sundararaman. rules. Save . Income Tax 2017-18 Rules. For Later. save. Related. Return. Uploaded by. Babu Sundararaman.

2017-03-01В В· It comprises all the basic knowledge that how to file income tax return.It shows the process to file income tax return. Like & subscribe our channel Income Tax Return forms Applicable for A.Y 2017-18 Rule 12 of Income tax Presumptive business income tax return applicable in cases where business income is

The e-filing process for ITR-1 will be enabled from April 1 and ITR can be filed until July 31. - How to file Income Tax Returns online for 2017-18 DIVISION OF TAXATION CORPORATION TAX INSTRUCTIONS FOR all 2017 Corporation Business Tax Returns and for Federal Income Tax purposes, see N.J.A.C. 18:7

DIVISION OF TAXATION CORPORATION TAX INSTRUCTIONS FOR all 2017 Corporation Business Tax Returns and for Federal Income Tax purposes, see N.J.A.C. 18:7 Income Tax Return last date for Assessment Year 2017-18: From tax filing requirement to e-verification of ITR, here’s all you need to know about filing tax return

The e-filing process for ITR-1 will be enabled from April 1 and ITR can be filed until July 31. - How to file Income Tax Returns online for 2017-18 2017 PERSONAL PROPERTY TAX FORMS AND • DO NOT FILE personal property tax returns with the income tax return. INSTRUCTIONS TANGIBLE PROPERTY TAX RETURNS

Here are the Income Tax Return (ITR) Forms for A.Y. 2017-18 (F.Y. 2016-17): Income Tax Return (ITR) filing has always left individuals perplexed. Scottish income tax 2017/18. Scotland Act 2016 builds on the devolution of income tax powers provided for in Scotland Act 2012. For the first time the Scottish

Published Editorial. Income Tax Return last date for Assessment Year 2017-18: From tax filing requirement to e-verification of ITR, here’s all you need to know Instructions for Filing ITR 6 For AY 2017-18, Download ITR 6 Form in PDF, Excel. Who can use ITR 6 Return Form, Who can not use ITR 6 Return Form 2017-18.