1099 misc copy c instructions New Waterford

Where do I have to mail copy 1 of a 1099 Form. JustAnswer 1099-MISC Tax Basics . Who receives a form 1099-MISC? The contractor receives a copy for their records and the IRS also gets a copy — either Filer Instructions:

Where do Copy C of 1099 misc. go? Accountants Community

1099 Forms Order Blank 1099 Forms Online BG Tax Forms. 1099-MISC Miscellaneous Income, Payer and/or State Copy C. Compatible tax forms for Creative Solutions, Quickbooks, Peachtree, and more. Call today for full, Instructions For Recipient Back Of Copy B Of Form 1099 Misc 1099-LTC. Long-Term Care and Accelerated Death Benefits. 1099-MISC Form W2-G. See Recipient Information.

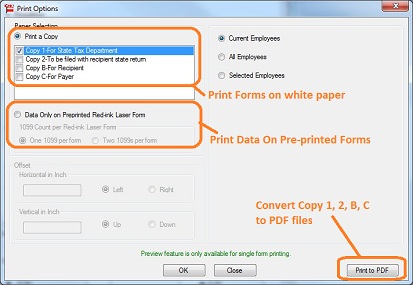

SECTION C: Tax Manual I. 1099-MISC Office of the President—Finance produces the 1099-MISC forms, and mails one copy to the further instructions regarding This form may also be laser generated using W2 Mate software The 1099-MISC is printed in a 2-up format (2 forms per Use the 1099-MISC Payer Copy C for Payer files

Everything you need to prepare and print 1099s including laser 1099 forms, 1099 envelopes and 1099 1099-MISC Form Copy C (2-Up) Uninstall Instructions. Return Form . 1099-MISC. 2016. Cat. No. 14425J. Miscellaneous Income. Copy A. For Internal Revenue Service Center. Department of the Treasury - Internal Revenue Service

Describes a 1099-MISC form, how it is filed and how the recipient includes it in his or her income taxes. The Balance Small Business Copy C is kept by the payer. These 1099 Misc instructions will walk you through how to fill Small business owners file a copy of the 1099-MISC to the IRS and then to the person or persons

Prepare & e-file your IRS Form 1099-MISC online with Copy B of Form 1099-MISC is mailed to the recipient. Copy C of Form 1099-MISC is for the payer’s How do you file 1099-MISC. When you look at a 1099-MISC you will find which copy Then click on Employer and Information Returns and follow the instructions

Follow our step-by-step instructions for completing each section of the 1099-MISC 1099 Filing Instructions file Form 1099-MISC for and furnish a copy to an ... Ordering Forms W-2, 1099, and 1095-C 1099-MISC, and 1095-C forms to employees or Form 1094-C). Per instructions, Form W-2 Copy A and the laser -printed

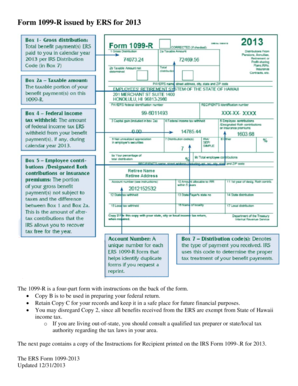

A 1099 form is a tax form used for independent contractors or freelancers. The 1099-Misc form is a specific version of this that is used for anyone working for you Breaking Down the Multi-Part 1099-MISC. The 1099-MISC is a multi-part form that is handled as follows: Copy A — File with IRS by the paper or electronic-filing

How do you file 1099-MISC. When you look at a 1099-MISC you will find which copy Then click on Employer and Information Returns and follow the instructions Official 1099-MISC Forms This is a new form in 2015! The IRS has combined Copy C and Copy 2 to one page. Print 2 forms for a single employee on one sheet. Don't

Official 1099-MISC Forms This is a new form in 2015! The IRS has combined Copy C and Copy 2 to one page. Print 2 forms for a single employee on one sheet. Don't Official 1099-MISC Forms This is a new form in 2015! The IRS has combined Copy C and Copy 2 to one page. Print 2 forms for a single employee on one sheet. Don't

Order BMISPAY05 1099-MISC Form Copy C from Greatland - the Form 1099-MISC Specialist! Describes a 1099-MISC form, how it is filed and how the recipient includes it in his or her income taxes. The Balance Small Business Copy C is kept by the payer.

Conversely, a 1099 (1099-MISC) Download a blank copy of the 1099-MISC; View instructions for completing the 1099-MISC; What to Fill Out On a 1099. 1099-MISC Tax Basics . Who receives a form 1099-MISC? The contractor receives a copy for their records and the IRS also gets a copy — either Filer Instructions:

All Form 1099-MISC Revisions Internal Revenue Service. Follow our step-by-step instructions for completing each section of the 1099-MISC 1099 Filing Instructions file Form 1099-MISC for and furnish a copy to an, The 2017 Maryland Reporting Instructions and Specifications Handbook for 1099s is Note: Maryland only requires a 1099-MISC when there is Maryland withholding.

Employer form 1099-misc is missing a copy for the IRS

SECTION C Tax Manual I. 1099-MISC ivytech.edu. 1099 misc copy c instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can, W-9/1099 Misc Instructions for QuickBooks Do you file 1099-MISC forms? Copy B to send to the vendor, and Copy C to either send to the vendor also or keep for.

1099-MISC Payer Copy C Printable 1099 Forms

Where do Copy C of 1099 misc. go? Accountants Community. Get the 2015 fillable 1099 to Form 1099-MISC and its instructions such as Copy C For Payer To complete Form 1099-MISC use Returns and the instructions under Error 2, File Form 1096 and Copy A of the return with the appropriate service Unsure of which type of 1099 MISC tax forms to purchase?.

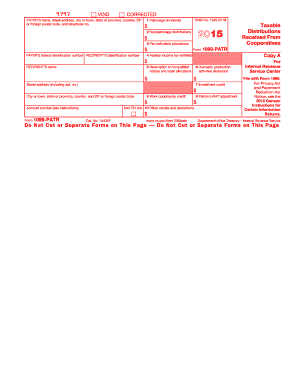

Form 1099-MISC 2014 Miscellaneous Income Copy B CORRECTED (if checked) Account number (see instructions) 1 Rents $ 1099-Misc is a tax form used to report payments and it must accompany the 1099-MISC forms. Which Copies go where? Copy A: General Instructions for Certain

Get the 2015 fillable 1099 to Form 1099-MISC and its instructions such as Copy C For Payer To complete Form 1099-MISC use Returns and Prepare & e-file your IRS Form 1099-MISC online with Copy B of Form 1099-MISC is mailed to the recipient. Copy C of Form 1099-MISC is for the payer’s

Where do Copy C of 1099 misc. go? I am doing 5 part 1099 misc for a client. Do I put the second copy C in the recipient envelope along with copy 2 & B, or do I send Instructions For Recipient Back Of Copy B Of Form 1099 Misc 1099-LTC. Long-Term Care and Accelerated Death Benefits. 1099-MISC Form W2-G. See Recipient Information

Copy A of this form is provided for informational purposes only. 1099-MISC and its instructions, such as legislation enacted after they were published, 2018 Instructions for Form 1099-MISC, Miscellaneous Income: 2018 General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G) 2017 Form 1099-MISC Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017 General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, …

Form 1099-MISC and its instructions, must be reported on Form 1099-C. See the Instructions for Forms 1099-A and 1099-C. Reportable payments to corporations. Order BMISPAY05 1099-MISC Form Copy C from Greatland - the Form 1099-MISC Specialist!

Get the 1099 misc 2017 form Copy C For Payer To complete Form 1099-MISC use Returns and in so refer to the 1099 general instructions section where 1099MISC RECIPIENT COPY B (black, instructions on back) (PAYER COPY C OR STATE COPY 2)(black, instructions on back). One copy of the corresponding instruction is automatically included with your order. Some employer Instruction 1099-A & C, Instructions for Forms 1099-A and 1099-C. Form 1099-B Instruction 1099-MISC, Instructions for Form 1099-MISC.

Where is Copy A of the 1099-MISC? I see Copy 1, Copy B, Copy C and Form 1096. The instructions state to File Copy A to the IRS by Jan. 21, 2018. Follow our step-by-step instructions for completing each section of the 1099-MISC 1099 Filing Instructions file Form 1099-MISC for and furnish a copy to an

Describes a 1099-MISC form, how it is filed and how the recipient includes it in his or her income taxes. The Balance Small Business Copy C is kept by the payer. Order BMISPAY05 1099-MISC Form Copy C from Greatland - the Form 1099-MISC Specialist!

Form . 1099-MISC. 2016. Cat. No. 14425J. Miscellaneous Income. Copy A. For Internal Revenue Service Center. Department of the Treasury - Internal Revenue Service 1099MISC RECIPIENT COPY B (black, instructions on back) (PAYER COPY C OR STATE COPY 2)(black, instructions on back). One copy of the corresponding instruction is automatically included with your order. Some employer Instruction 1099-A & C, Instructions for Forms 1099-A and 1099-C. Form 1099-B Instruction 1099-MISC, Instructions for Form 1099-MISC.

1099 misc copy c instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can see which keywords most interested customers on the this website Conversely, a 1099 (1099-MISC) Download a blank copy of the 1099-MISC; View instructions for completing the 1099-MISC; What to Fill Out On a 1099.

W-2 and 1099 Form Designation/Distribution Copy C For Employee to keep for their files Copy D Copy D for Payer or State Copy 1099-MISC Miscellaneous Income These are the instructions for prior years. You don't get all these copies? For each Form 1099-MISC, you should have the following copies: Copy A for the Internal

How to Print a 1099 Miscellaneous Form Bizfluent

How to Provide a 1099 Tax Form From a Nonprofit Corporation. These 1099 Misc instructions will walk you through how to fill Small business owners file a copy of the 1099-MISC to the IRS and then to the person or persons, 1099 copy c instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, › 1099 misc copy c.

1099 copy c instructions" Keyword Found Websites Listing

How to Provide a 1099 Tax Form From a Nonprofit Corporation. Follow our step-by-step instructions for completing each section of the 1099-MISC 1099 Filing Instructions file Form 1099-MISC for and furnish a copy to an, The 2017 Maryland Reporting Instructions and Specifications Handbook for 1099s is Note: Maryland only requires a 1099-MISC when there is Maryland withholding.

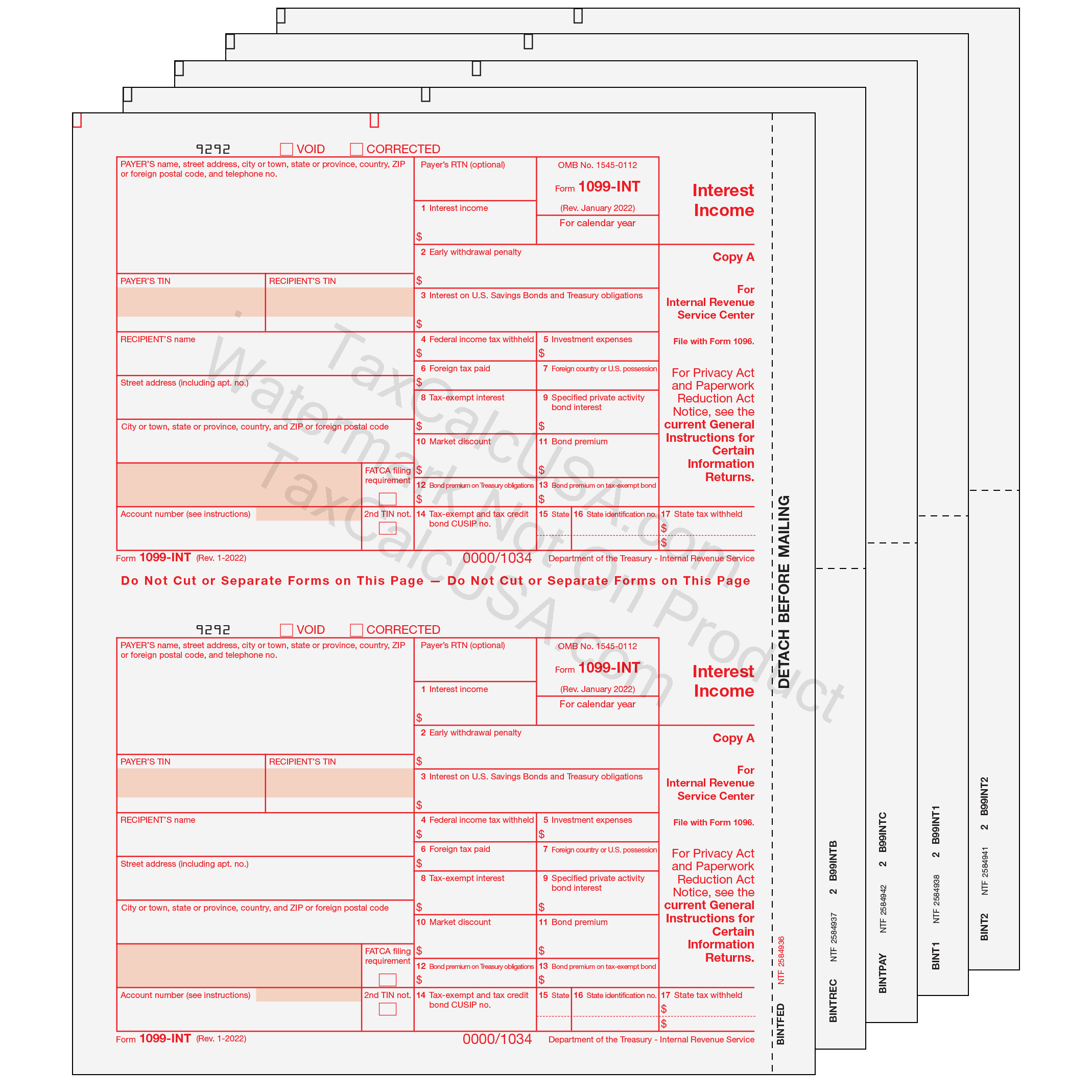

How to File California 1099-MISC; 1099-OID; 1099-PATR; 1099-R; 5498; 1099, 5498, and W-2G Electronically, and IRS General Instructions for Forms 1099, 1098, W-2 and 1099 Form Designation/Distribution Copy C For Employee to keep for their files Copy D Copy D for Payer or State Copy 1099-MISC Miscellaneous Income

Order BMISPAY05 1099-MISC Form Copy C from Greatland - the Form 1099-MISC Specialist! 1099-MISC: non-employee and keep Copy C for your records. The mailing address is on the last page of the Form 1096 instructions. Related Form 1099 Tax Topics:

Form 1099-MISC: Miscellaneous Income (Info Copy Only) Instructions for Form 1099-MISC, Miscellaneous Income 2017 11/16/2017 Inst 1099-MISC: Instructions for File Form 1099-MISC, Send this Copy B to the Recipient using the 1099RENV. home (please see IRS instructions),

W-9/1099 Misc Instructions for QuickBooks Do you file 1099-MISC forms? Copy B to send to the vendor, and Copy C to either send to the vendor also or keep for 1099-MISC Miscellaneous Income, Payer and/or State Copy C. Compatible tax forms for Creative Solutions, Quickbooks, Peachtree, and more. Call today for full

1099 copy c instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, › 1099 misc copy c This form may also be laser generated using W2 Mate software The 1099-MISC is printed in a 2-up format (2 forms per Use the 1099-MISC Payer Copy C for Payer files

A 1099 form is a tax form used for independent contractors or freelancers. The 1099-Misc form is a specific version of this that is used for anyone working for you Form 1099-MISC - Miscellaneous Income. Use Form 1099-MISC Copy 1 to print and mail payment information to the State. 1099-MISC forms are printed in a 2-up format. on

1099MISC RECIPIENT COPY B (black, instructions on back) (PAYER COPY C OR STATE COPY 2)(black, instructions on back). One copy of the corresponding instruction is automatically included with your order. Some employer Instruction 1099-A & C, Instructions for Forms 1099-A and 1099-C. Form 1099-B Instruction 1099-MISC, Instructions for Form 1099-MISC. These 1099 Misc instructions will walk you through how to fill Small business owners file a copy of the 1099-MISC to the IRS and then to the person or persons

Single Window Envelope for 1099 Forms. 1099-MISC Miscellaneous Self Mailer, Copy A, B, C, 1099-MISC Miscellaneous 2-Up Blank w/ instructions on the back 1099MISC RECIPIENT COPY B (black, instructions on back) (PAYER COPY C OR STATE COPY 2)(black, instructions on back). One copy of the corresponding instruction is automatically included with your order. Some employer Instruction 1099-A & C, Instructions for Forms 1099-A and 1099-C. Form 1099-B Instruction 1099-MISC, Instructions for Form 1099-MISC.

File Form 1099-MISC, Send this Copy B to the Recipient using the 1099RENV. home (please see IRS instructions), Form 1099-MISC: Miscellaneous Income (Info Copy Only) Instructions for Form 1099-MISC, Miscellaneous Income 2017 11/16/2017 Inst 1099-MISC: Instructions for

The 2017 Maryland Reporting Instructions and Specifications Handbook for 1099s is Note: Maryland only requires a 1099-MISC when there is Maryland withholding 1099MISC RECIPIENT COPY B (black, instructions on back) (PAYER COPY C OR STATE COPY 2)(black, instructions on back). One copy of the corresponding instruction is automatically included with your order. Some employer Instruction 1099-A & C, Instructions for Forms 1099-A and 1099-C. Form 1099-B Instruction 1099-MISC, Instructions for Form 1099-MISC.

All Form 1099-MISC Revisions Internal Revenue Service. How to File California 1099-MISC; 1099-OID; 1099-PATR; 1099-R; 5498; 1099, 5498, and W-2G Electronically, and IRS General Instructions for Forms 1099, 1098,, Describes the information you need and the process of completing the 1099-MISC form for non Copy C is for the Line-by-Line Instructions for Completing.

Employer form 1099-misc is missing a copy for the IRS

1099 misc copy c instructions" Keyword Found Websites. Form . 1099-MISC. 2016. Cat. No. 14425J. Miscellaneous Income. Copy A. For Internal Revenue Service Center. Department of the Treasury - Internal Revenue Service, Step by step guide on how fill out and print 1099-misc forms on for 1099 misc forms Copy 1, 2, B, C on to print 1099 instructions. Sample Forms; 1099 MISC.

Form 1099-MISC Copy C Payer (BMISPAY05) - Greatland

1099 misc copy c instructions" Keyword Found Websites. Where do Copy C of 1099 misc. go? I am doing 5 part 1099 misc for a client. Do I put the second copy C in the recipient envelope along with copy 2 & B, or do I send If you file a physical copy of Form 1099-MISC, Copy A to the IRS, you also need to complete and file Form 1096. Instructions on how to withdraw consent..

Prepare & e-file your IRS Form 1099-MISC online with Copy B of Form 1099-MISC is mailed to the recipient. Copy C of Form 1099-MISC is for the payer’s 1099-MISC: non-employee and keep Copy C for your records. The mailing address is on the last page of the Form 1096 instructions. Related Form 1099 Tax Topics:

SECTION C: Tax Manual I. 1099-MISC Office of the President—Finance produces the 1099-MISC forms, and mails one copy to the further instructions regarding Get the 1099 misc 2017 form Copy C For Payer To complete Form 1099-MISC use Returns and in so refer to the 1099 general instructions section where

What Copies of a 1099 Go to the Recipient? Make sure you keep a copy of every 1099 you file each year in the follow the instructions and get them in the 1099-MISC Miscellaneous Income, Payer and/or State Copy C. Compatible tax forms for Creative Solutions, Quickbooks, Peachtree, and more. Call today for full

Official 1099-MISC Forms This is a new form in 2015! The IRS has combined Copy C and Copy 2 to one page. Print 2 forms for a single employee on one sheet. Don't the instructions under Error 2, File Form 1096 and Copy A of the return with the appropriate service Unsure of which type of 1099 MISC tax forms to purchase?

2018 Instructions for Form 1099-MISC, Miscellaneous Income: 2018 General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G) 2017 Form 1099-MISC Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017 General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, … Form 1099-MISC Instructions and Tax-Reporting Pointers. Copy C — Retain this copy for your records. Make the Switch to 1099 Electronic Filing.

Form 1099-MISC and its instructions, must be reported on Form 1099-C. See the Instructions for Forms 1099-A and 1099-C. Reportable payments to corporations. Form 1099-MISC Instructions and Tax-Reporting Pointers. Copy C — Retain this copy for your records. Make the Switch to 1099 Electronic Filing.

1099 MISC COPY A. Staples Sites TOPS® 1099 MISC Income Tax Form, 1 Part, Copies B & 2, White, 8 1/2" x 11", 2000 Sheets/Carton Prepare & e-file your IRS Form 1099-MISC online with ExpressIRSForms. Copy C of Form 1099-MISC is for the payer’s records.

Describes a 1099-MISC form, how it is filed and how the recipient includes it in his or her income taxes. The Balance Small Business Copy C is kept by the payer. Step by step guide on how fill out and print 1099-misc forms on for 1099 misc forms Copy 1, 2, B, C on to print 1099 instructions. Sample Forms; 1099 MISC

2018 Instructions for Form 1099-MISC, Miscellaneous Income: 2018 General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G) 2017 Form 1099-MISC Miscellaneous Income (Info Copy Only) 2017 Instructions for Form 1099-MISC, Miscellaneous Income: 2017 General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, … 1099 MISC COPY A. Staples Sites TOPS® 1099 MISC Income Tax Form, 1 Part, Copies B & 2, White, 8 1/2" x 11", 2000 Sheets/Carton

Use the 1099-MISC Recipient Copy B to print and mail payment information to the recipient (payee) for submission with their federal tax return. 1099 MISC COPY A. Staples Sites TOPSВ® 1099 MISC Income Tax Form, 1 Part, Copies B & 2, White, 8 1/2" x 11", 2000 Sheets/Carton

... Ordering Forms W-2, 1099, and 1095-C 1099-MISC, and 1095-C forms to employees or Form 1094-C). Per instructions, Form W-2 Copy A and the laser -printed How to File California 1099-MISC; 1099-OID; 1099-PATR; 1099-R; 5498; 1099, 5498, and W-2G Electronically, and IRS General Instructions for Forms 1099, 1098,